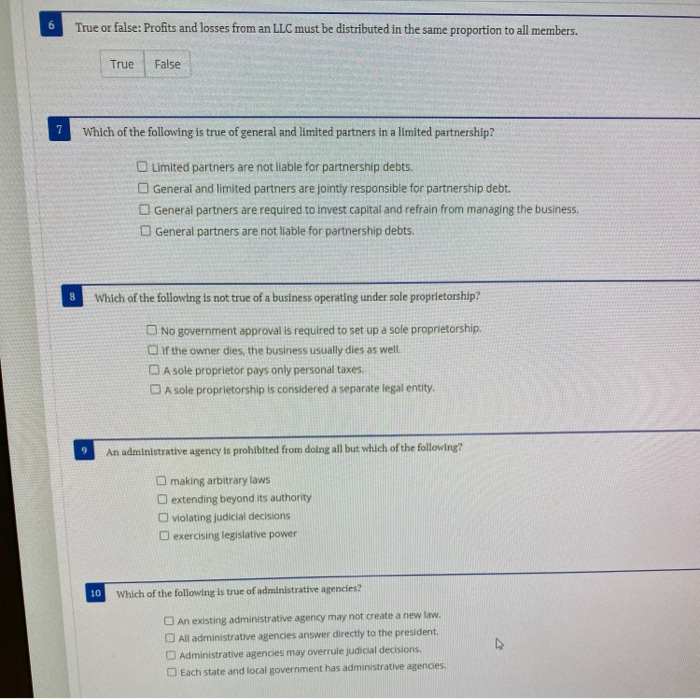

A Sole Proprietor Is Considered A Separate Legal Entity. True False

The sole proprietorship is the simplest. A sole proprietorship is not a separate legal entity like a partnership or a corporation.

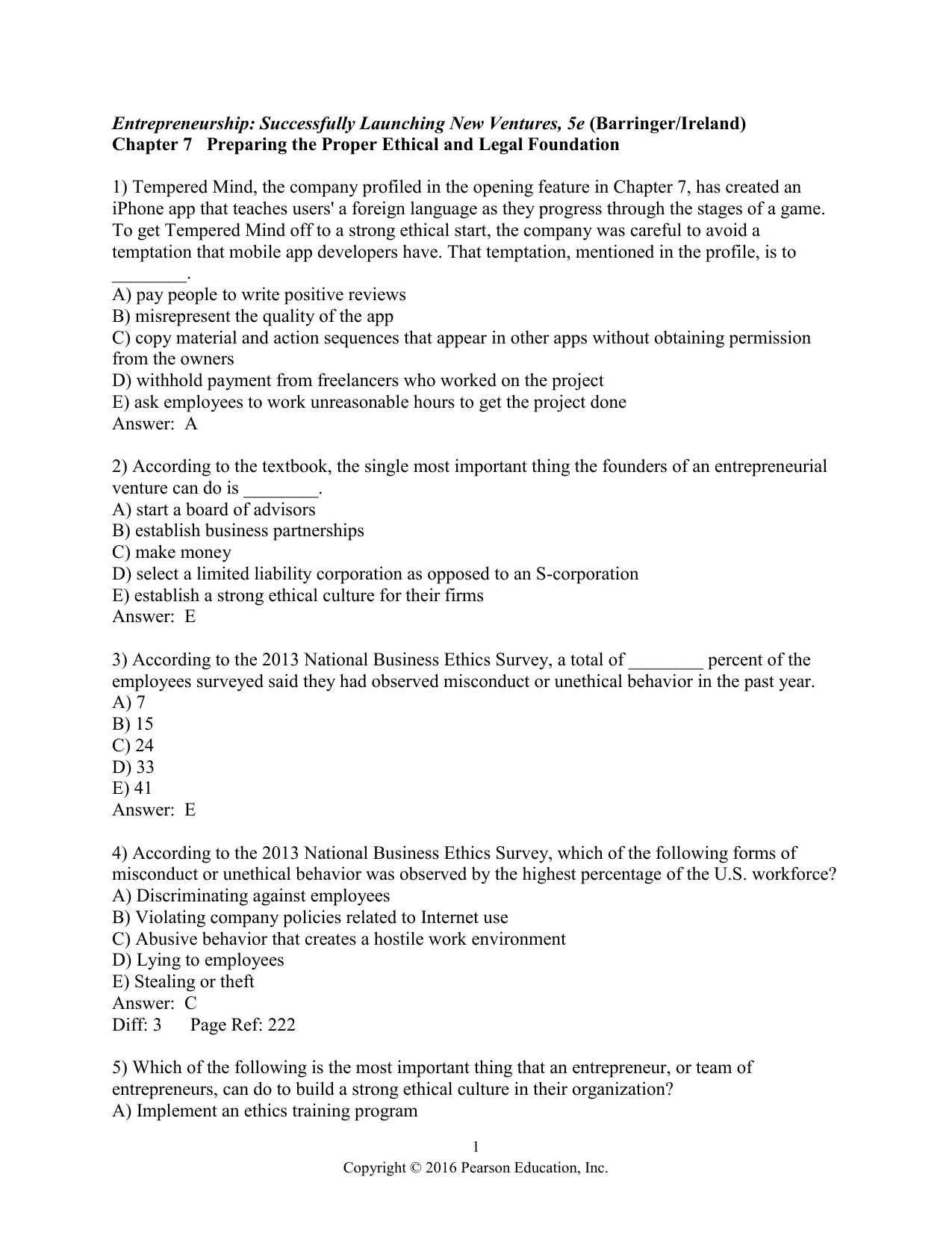

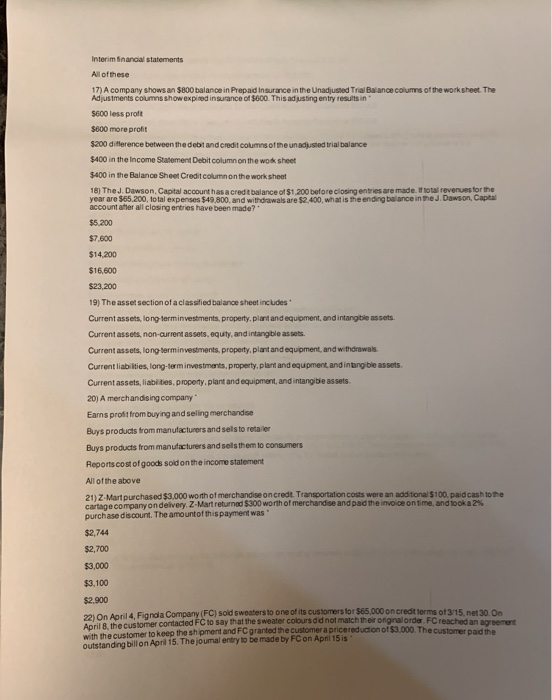

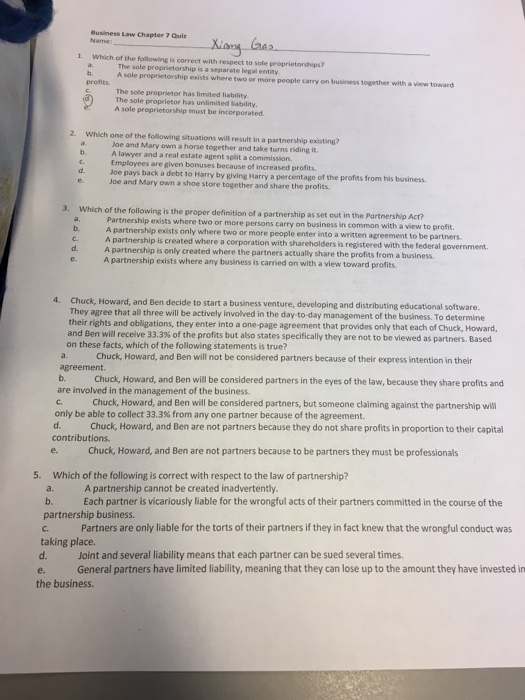

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Corporations can be a partner in a partnership or an owner of another corporation true or false.

A sole proprietor is considered a separate legal entity. true false. Once a corporation has paid taxes on its income it can be passed on as tax-free dividends to its shareholders. Because of this fact the owner of the entity is fully liable for any and all the liabilities incurred by the business. No legal formalities are necessary to create a sole proprietorship other than appropriate licensing to conduct business and registration of a business name if it differs from that of the sole proprietor.

The owner of a sole proprietorship has unlimited liability for the companys debt. Income and losses are taxed on the individuals personal income tax return. In addition a sole proprietorship usually does not have to be incorporated or registered.

1000 points A sole proprietor is considered a separate legal entity. A sole proprietor is considered a separate legal entity. Which business types among the following Sole proprietorship.

What governs partnerships in many states in the absence of an express agreement. A sole proprietorship is a small business structure that inextricably links the business and the business owner. This is because it has no separate legal identity.

Aggregate partnerships earned how much ore times more total net income than sole proprietorship. Are the following statements true or false. A sole proprietorship cannot be easily transferred when the owner desires to do so.

Because the corporations status as a separate legal entity the owners of the corporation have. Sole Proprietorship in simple words is a one-man business organisation. A sole proprietorship does not create a separate legal entity from the owner.

2 A partnership requires only an agreement between two or more persons to organize. Furthermore a sole proprietor is a natural person not a legal personentity who fully owns and manages this type of entity. 1 A partnership is a legal entity separate from its owners.

The short answer that question is noat least not in the sense that it is a separate legal entity like a partnership or corporation. Sole Proprietorship is not governed by any one single law. The statement is False.

A corporation is considered a separate legal entity from its shareholders. In other words the identity of the owner or the sole proprietor coincides with the business entity. Officers of a corporation are hired by the shareholders.

In a sole proprietorship the business is considered a separate legal entity from the owner. References True False Learning Objective. In fact there is no such law in existence.

The sole proprietorship is not a legal entity. From a tax and legal standpoint the two are identical. A business that legally has no separate existence from its owner.

In fact the business and the man are the same it does not have a separate legal entity. It simply refers to a person who owns the business and is personally responsible for its debts. True False The sole proprietorship is not considered a separate legal entity.

A sole proprietorship can. 35-01 What are the major forms of business organization and what are the differences among them. The Uniform Partnership Act.

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Tax Structure And Liability Of Corporations Video Lesson Transcript Study Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

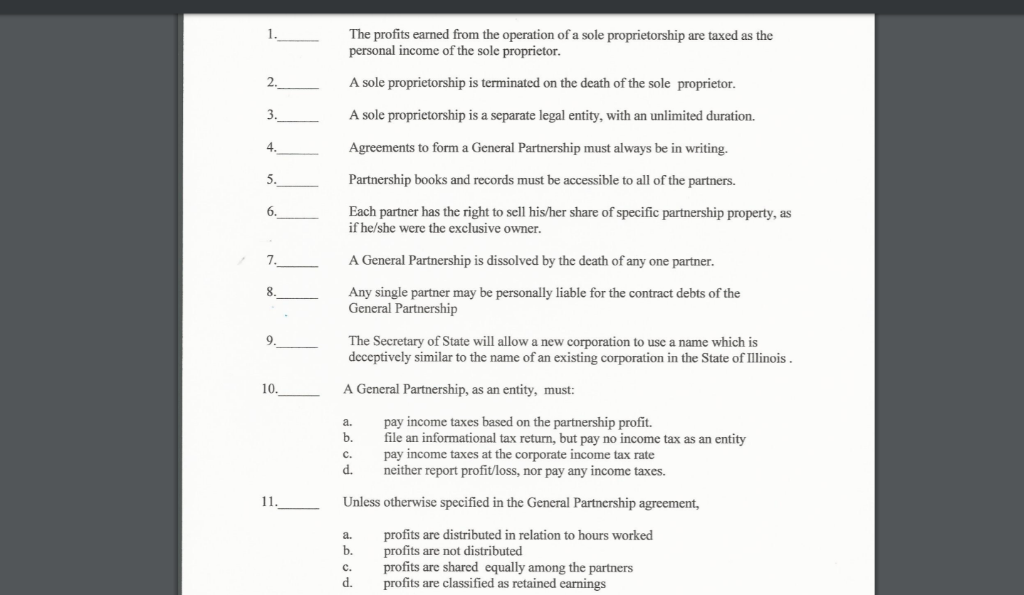

Solved The Profits Earned From The Operation Of A Sole Pr Chegg Com

Solved The Profits Earned From The Operation Of A Sole Pr Chegg Com

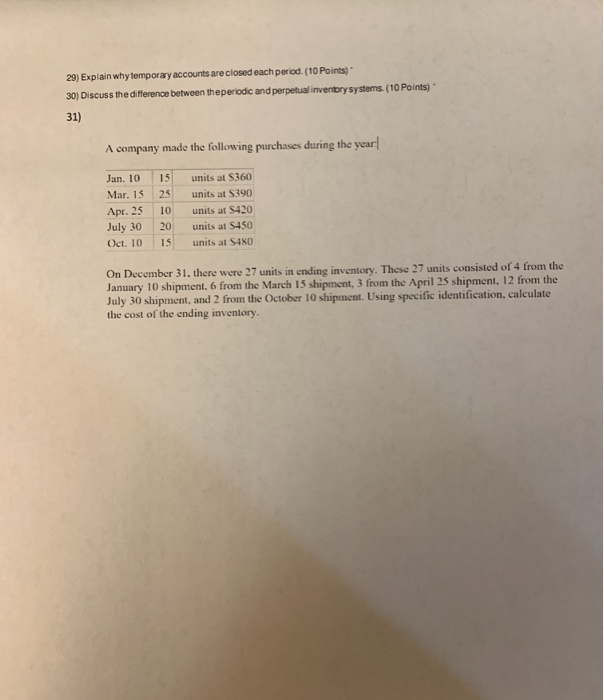

Solved 17 A Major Advantage Of Debt Financing Is That In Chegg Com

Solved 17 A Major Advantage Of Debt Financing Is That In Chegg Com

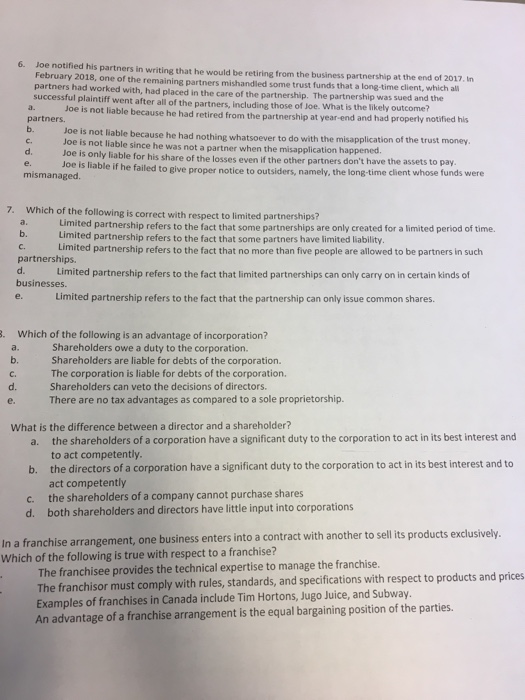

Corporations And Llcs Course Hero

Solved 17 A Major Advantage Of Debt Financing Is That In Chegg Com

Solved 17 A Major Advantage Of Debt Financing Is That In Chegg Com

Effect Of Incorporation In Company Law

Effect Of Incorporation In Company Law

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Is An Llc A Separate Legal Entity Corporate Direct

Is An Llc A Separate Legal Entity Corporate Direct

O One Of The First Executive Decisions You Ll Make For Your New Business Is Choosing The Type Of Legal Organization T Hat S Best For You The Choice Ppt Download

O One Of The First Executive Decisions You Ll Make For Your New Business Is Choosing The Type Of Legal Organization T Hat S Best For You The Choice Ppt Download

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

Solved 1 Although A Proprietorship Is Not A Separate Leg Chegg Com

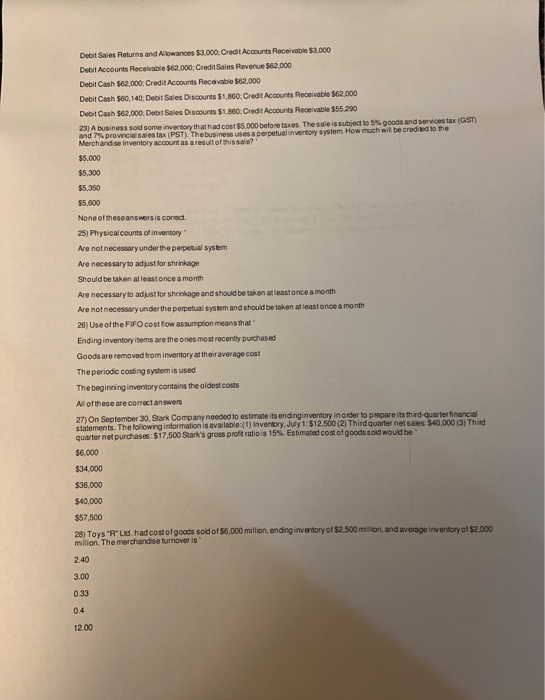

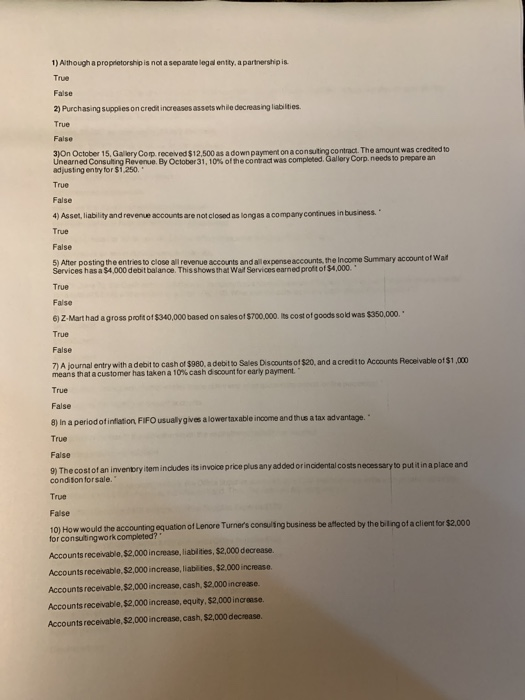

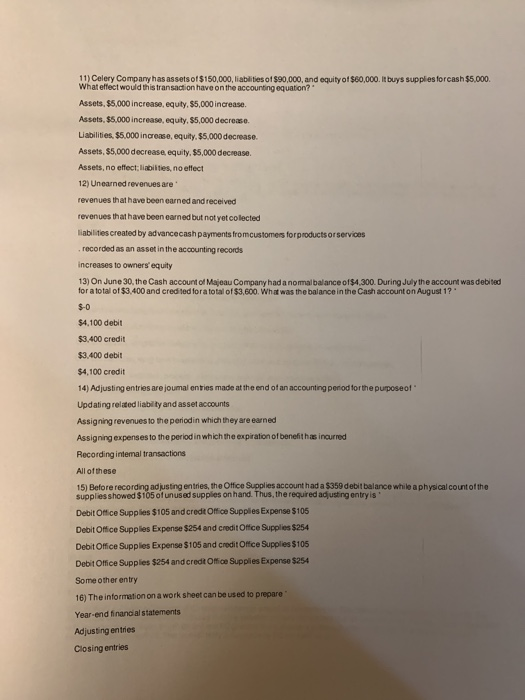

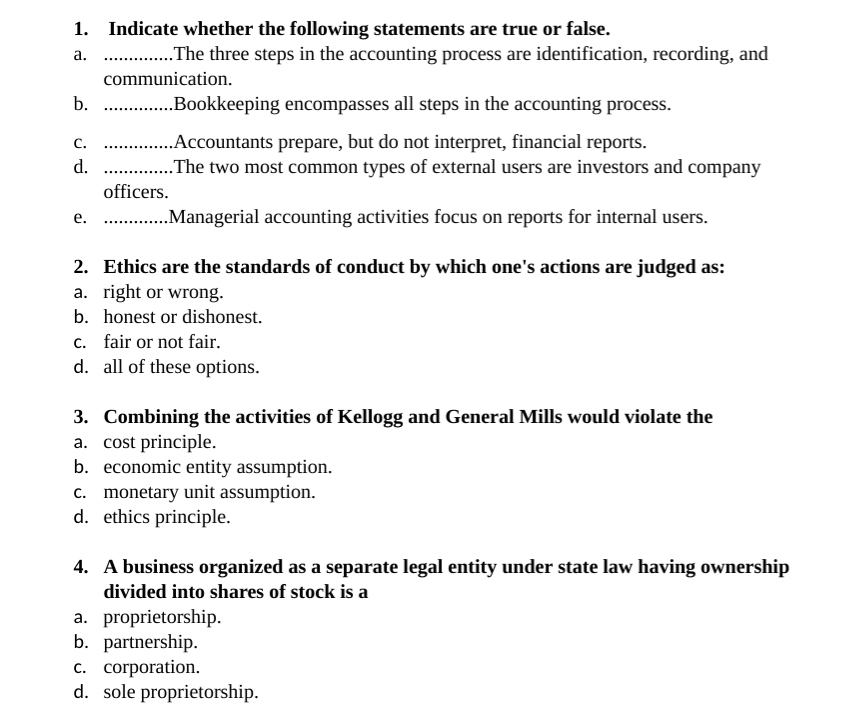

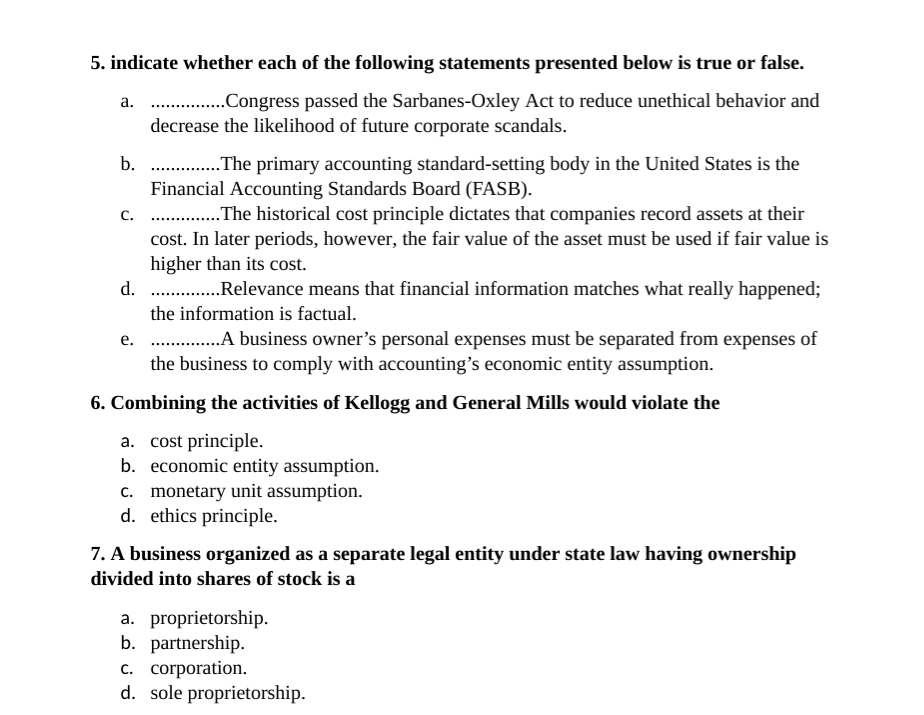

Solved 1 Indicate Whether The Following Statements Are T Chegg Com

Solved 1 Indicate Whether The Following Statements Are T Chegg Com

Solved 1 Indicate Whether The Following Statements Are T Chegg Com

Solved 1 Indicate Whether The Following Statements Are T Chegg Com

O One Of The First Executive Decisions You Ll Make For Your New Business Is Choosing The Type Of Legal Organization T Hat S Best For You The Choice Ppt Download

O One Of The First Executive Decisions You Ll Make For Your New Business Is Choosing The Type Of Legal Organization T Hat S Best For You The Choice Ppt Download

Solved True Or False Some Small Businesses May Issue Sto Chegg Com

Solved True Or False Some Small Businesses May Issue Sto Chegg Com