Do Professional Corporations Receive 1099

There is no need to send 1099-MISCs to corporations. The answer is no because the kitchen remodeling was for personal not business reasons.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

Do professional corporations receive 1099. You should also issue 1099-MISC forms for. The company was not required to issue a Form 1099 to a corporation. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

However a few exceptions exist that require a. In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations. Those whos names contain Corporation Company Incorporated Limited Corp Co Inc.

Do I file that on my personal taxes or business taxes. Most corporations dont get 1099-MISCs Another important point to note. No corporations S Corps and C Corps are exempted from requiring a 1099-MISC therefore you do not normally have to send this form to any corporations including an S Corporation.

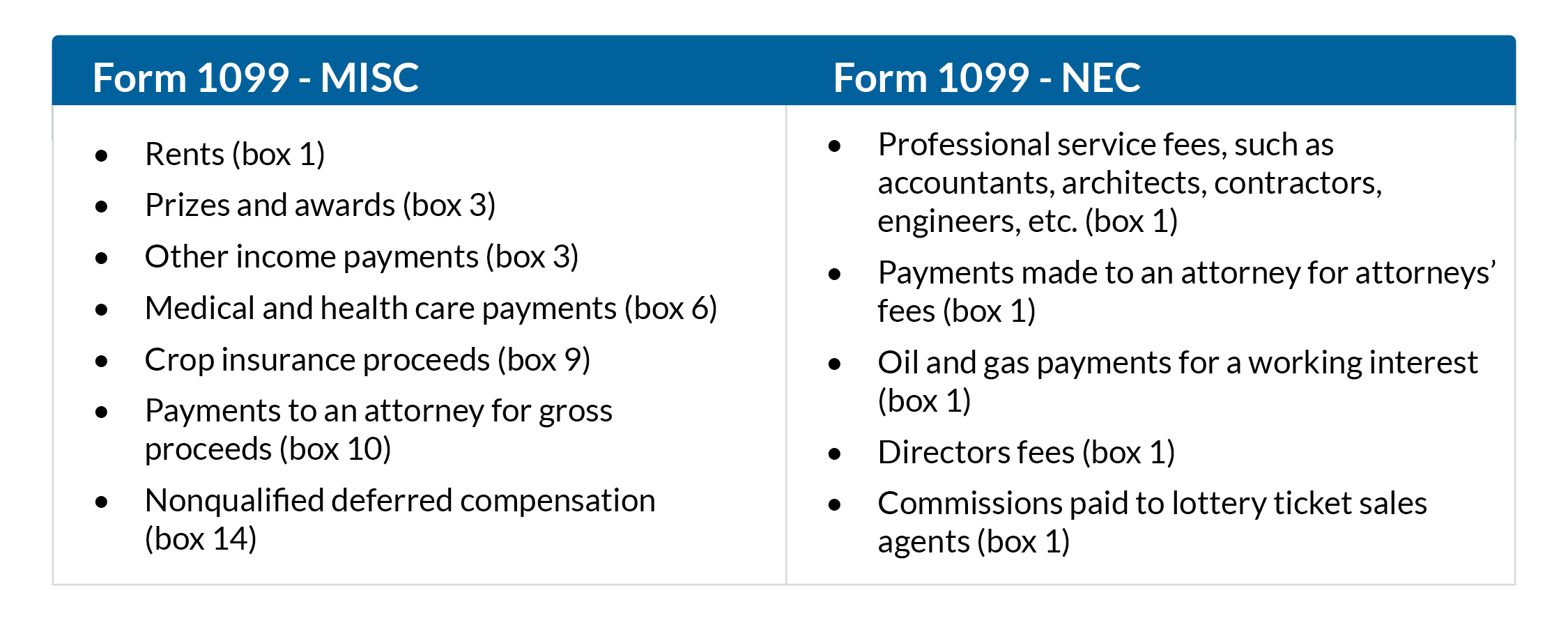

Use Form 1099-MISC to report gross proceeds of 600 or more during the year including payments to corporations Box 10. 12711 1050 AM. As a general rule a business doesnt need to issue a 1099 to a corporation or an LLC organized as a corporation.

Use Form 1099-NEC to report payment of attorney fees for services. Or Ltd are also exempt from 1099 requirements with the exception of those you pay for medical or health care or law firms that youve hired for legal services Those corporations that have filed a S-Corp election with the IRS. Lawyer fees even if the attorney is incorporated.

Sole proprietors partnerships and unincorporated contractors do. IRS uses form 1099MISC and 1099-NEC to track payments. Attorney Fees and Corporations Form 1099s must be sent to sole proprietors S corporations LLCs and partnerships.

A professional corporation except for law firms. When entering your normal business receipts just make sure it includes the amount from this company. Required to issue a.

Directors who receive directors fees and other remuneration including payments made after retirement. The 1099 most commonly applies to the contractor relationship. I have a s corporation and I received a form 1099 nec.

Gross proceeds arent fees for an attorneys legal services. You may begin to receive these documents as. Additionally it is not required to provide 1099 for payments regarding personal matters only professional ones.

Payments made to for-profit medical providers. You are not required to report payments to pharmacies for prescription drugs. Typically youll receive a 1099 because you earned some form of income from a non-employer source.

Independent contractors file taxes independently and pay a self-employment tax. There is no special reporting. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

The 1099 tracks income received. There are a few exceptions to that rule however. The exemption from issuing Form 1099-MISC to a corporation does not apply to payments for medical or health care services provided by corporations including professional corporations.

Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year. See above and payments for medical or health care services see page 6 of the instructions. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations.

Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. Generally speaking a business is not required to file a 1099 regarding contractors to whom less than 600 was paid. You do not need to send a Form 1099-MISC to.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. The exception to this rule is with paying attorneys. My understanding is that in general people who pay more than 600 per year.

To a corporation for work performed such as to contractors etc are not. Its a common belief that businesses dont need to send out 1099-NEC forms to corporations. If - Answered by a verified Tax Professional.

They are amounts paid in other ways like in a lawsuit settlement agreement for example.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

The 411 On The 1099 What You Need To Know Rbt Cpas Llp

The 411 On The 1099 What You Need To Know Rbt Cpas Llp

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc Form Download Sample 1099 Government Form Eclipse Corporation Letter Template Word Doctors Note Template Fillable Forms

1099 Misc Form Download Sample 1099 Government Form Eclipse Corporation Letter Template Word Doctors Note Template Fillable Forms

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It