How To Deregister For Vat South Africa

Section 24 1 of the VAT Act determines that a vendor ceases to be liable to be registered as a VAT vendor where the Commissioner for SARS is satisfied that the total value of the vendors taxable supplies in the period of 12 months commencing at the beginning of any tax period of the vendor will not be more than R1 million. If your company or close corporation ceases to operate you may deregister it with the Companies and Intellectual Property Commission CIPC.

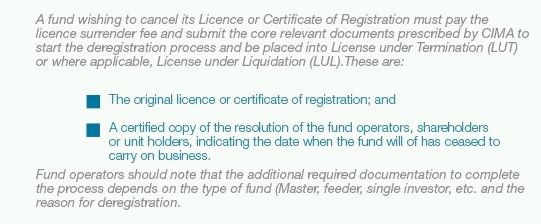

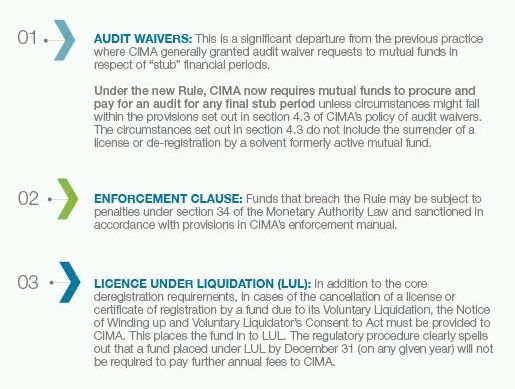

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Life without worrying about VAT might be an attractive thought for many small business owners.

How to deregister for vat south africa. Select Maintain SARS Registered Details. A vendor who has taxable supplies of less than R1 million should consider whether they wish to remain registered as a VAT vendor. Two years later it was increased to 14 and it remained that way until 2018 when new changes were introduced.

A decision to deregister for VAT should not be taken lightly as deregistration is in itself a VAT event. However for this concession to apply the vendor had to deregister from VAT before 30 June 2009. If you wish to deregister your existing company we will prepare the legal documentation required and deregister your company at CIPC.

A vendor will be deregistered only if all outstanding liabilities or obligations. The VAT rate in South Africa has faced several increments over the years since its introduction in 1991. Initially it was levied at a statutory rate of 10 in 1991.

You can apply online or via a written form in the mail. I want to deregister my company. It can also be dissolved as result of liquidation.

The Maintain SARS Registered Details screen will display. Find out more about how to. Procedure to be followed to deregister from VAT The procedure that must be followed in order to deregister from VAT is to submit a completed VAT123 form at the SARS branch office where the vendor is registered.

I want to re-instate my company which has been finally deregistered. Deceased Estate After the date of death a new taxpayer is created the deceased estate. Click on Additional Services select Customers and then select Document Status.

Deregister or liquidate company or CC. To check the tracking number go to Customer Transactions under Customers. The types of supplies made profile of customers and VAT incurred on expenditure should be taken into account in making this decision.

Implies that a business ceases to be registered as either a company or close corporation no legal persona or standing since it no longer is doing business and it has no. 89 of 1991 as amended. 8 12 weeks Cost.

Select I Agree to confirm that you are authorised to perform maintenance functions of the. Navigate to SARS Registered Details functionality. Sections dealing with deregistration as a VAT vendor.

1 Company Registration Documents 2 Business Bank Account 3 Proof you are Trading 4 South African business Address. You must notify South African Revenue Service SARS within 21 days of discontinuing your business. However for this concession to apply the vendor had to deregister from VAT before 30 June 2009.

Fortunately you wont have to queue at a branch to do it you can do it online. A vendor will be deregistered only if all outstanding liabilities or obligations. Informing the eFiling software wizard that you have ceased to be a tax resident is sufficient along with the effective date.

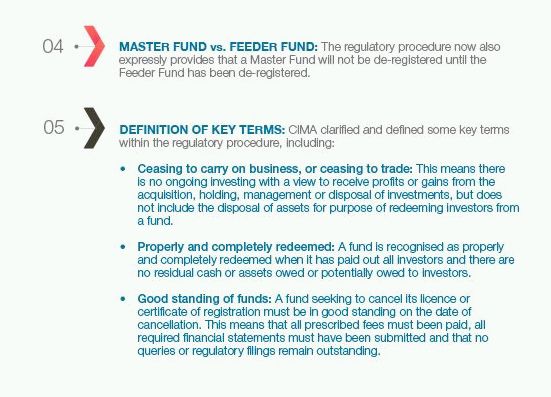

20090227 SP V3002 Postal code South African Revenue Service Name Surname Capacity Signature Can only be one of the following persons of the legal entity individual owner partner public officer trustee curator liquidator. Click VAT under. Value-Added Tax VAT 14.

If you apply for deregistration online HMRC will send confirmation to your VAT online account. The administrative requirements of VAT may then be too burdensome and it might therefore be decided to deregister the company for VAT purposes. On date of deregistration all assets.

Get Your VAT Registration Number Now. R 990 all inclusive. Register for tax as a category a special trust In an assessment of the deceased estate the deceased estate.

The most common reasons would be when a business ceases being sold or your turnover could fall below R 1 million. A vendor can request voluntary deregistration from SARS by completing a VAT 123 form. The executor must complete the return of income derived by the estate and submit the resulting claim for normal tax against the assets of the estate.

SARS will need to be informed that you wish to deregister from income tax because you are now a non-resident. I know that many businesses which were voluntarily registered decided to call it a day when the new limited cost trader category was introduced to the flat rate scheme FRS on 1 April 2017 with its very high rate of 165 which removed most of the financial savings that scheme users had. If you are being forced to deregister for VAT through compulsory deregistration HMRC may allow the registration to remain open for up to six months to allow time to tie up all the loose ends.

Procedure to be followed to deregister from VAT The procedure that must be followed in order to deregister from VAT is to submit a completed VAT123 form at the SARS branch office where the vendor is registered. Scan and e-mail the letter to deregistrationscipccoza. You can track the progress of your document by clicking on Track my transactions on the home page.

Just complete the online form below to start. Motivation for the VAT deregistration could be caused by a various reasons. Your business will remain liable for any outstanding VAT debts while it was registered as a vendor.

VAT would immediately be payable on the lower of the cost or market value of the whole property. I am fully aware of my duties and responsibilities as per the Value-Added Tax Act No. When you decide to deregister for Value added tax you need to keep a few important things in mind.

Turnover Tax Deregistration Wk Wilton Associates

Turnover Tax Deregistration Wk Wilton Associates

How To Choose The Best Insurance Company In Canada Posts By Yeasin Hossain What Is Software Bookkeeping Services Asset Management

How To Choose The Best Insurance Company In Canada Posts By Yeasin Hossain What Is Software Bookkeeping Services Asset Management

Deregistration Tips Tax Adviser

Deregistration Tips Tax Adviser

Fill Out Form Deregister From Germany Residence Deregistration Online

Fill Out Form Deregister From Germany Residence Deregistration Online

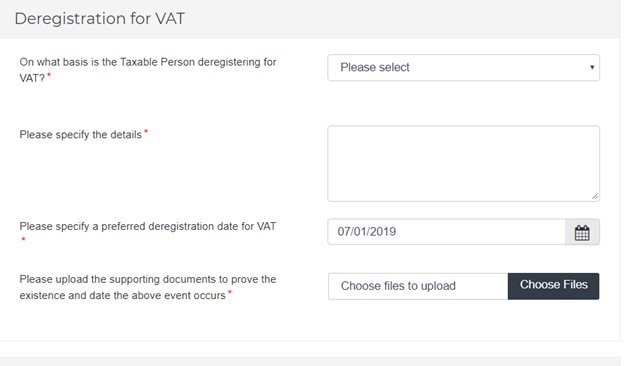

Vat Deregistration In Uae How To Apply For Vat Deregistration

Vat Deregistration In Uae How To Apply For Vat Deregistration

Vat Registration For A Company In South Africa Youtube

Vat Registration For A Company In South Africa Youtube

Fill Out Form Deregister From Germany Residence Deregistration Online

Fill Out Form Deregister From Germany Residence Deregistration Online

Vat Deregistration In Uae How To Apply For Vat Deregistration

Vat Deregistration In Uae How To Apply For Vat Deregistration

Vat Notches Voluntary Registration And Bunching Theory And Uk Evidence Vat Notches Voluntary Registration And Bunching Theory And Uk Evidence

Vat Notches Voluntary Registration And Bunching Theory And Uk Evidence Vat Notches Voluntary Registration And Bunching Theory And Uk Evidence

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Cancellation Of Licence Deregistration Of Mutual Funds Finance And Banking Cayman Islands

Uae Taxes Your Queries On Vat Deregistration Answered Yourmoney Taxation Gulf News

Uae Taxes Your Queries On Vat Deregistration Answered Yourmoney Taxation Gulf News

How To Use Global Vat Explorer Case Study 1 Ibfd

Vat 123 Form Fill Online Printable Fillable Blank Pdffiller

Vat 123 Form Fill Online Printable Fillable Blank Pdffiller

How To Sign Up To Making Tax Digital For Vat Youtube

How To Sign Up To Making Tax Digital For Vat Youtube