Irs Business Ownership Change Form

REV-1706 -- BusinessAccount Cancellation Form. A new state EIN may also be needed.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

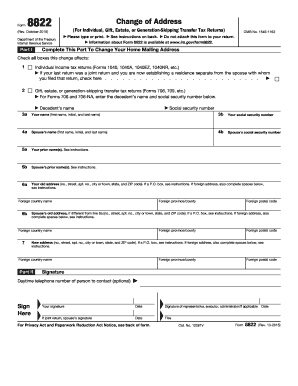

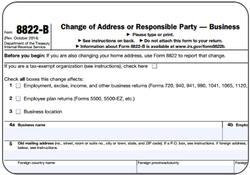

Form 8822-B must be filed within 60 days of a change in the identity of the responsible party or the partys identifying information.

Irs business ownership change form. Write to us at the address where you filed your return informing the Internal Revenue Service IRS of the name change. It could take days or weeks for the IRS to process it. The IRS mandates the Form 8822-B is filed within 60 days of the membership change.

Business Licensing Service PO Box 9034. Your form of business determines which income tax return form you have to file. By the Internal Revenue Service.

If you are a. Achange in filing status will be effective only at. Complete Line 3 if you or your spouse changed last name due to marriage divorce etc.

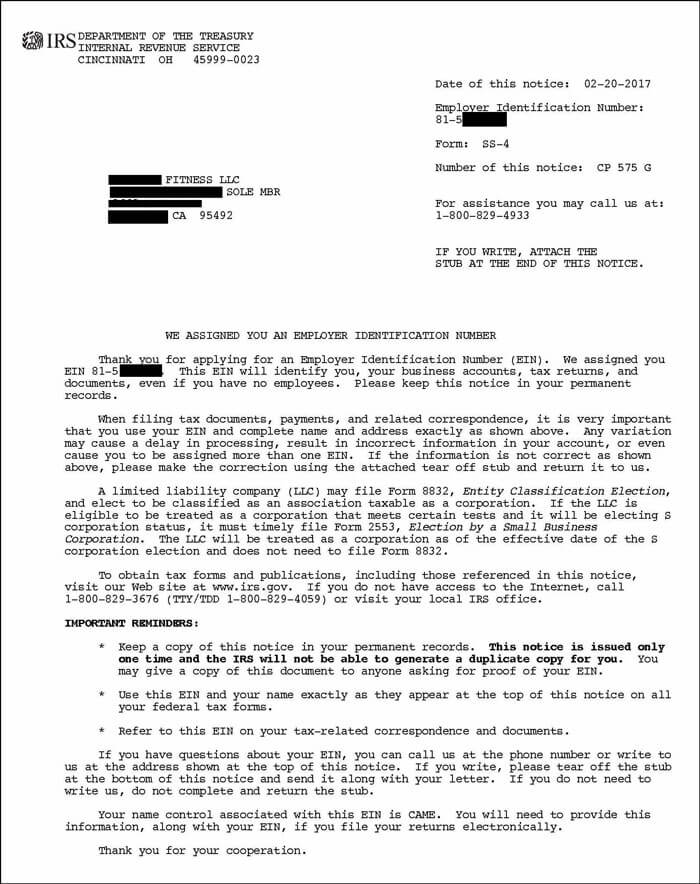

A new registration form PA-100 must be completed if you have received a new EIN. With an equity sale there may be no requirement to report a business ownership change to the IRS. The IRS lists several.

REV-1176 -- e-TIDES Administrative Access Change Request Form. When a New EIN Is Required for Your Business. Teletype TTY users may use the WA Relay Service by calling 711.

September 2018 Department of the Treasury Internal Revenue Service. Legal and tax considerations enter into selecting a business. A Limited Liability Company LLC is a business structure allowed by state statute.

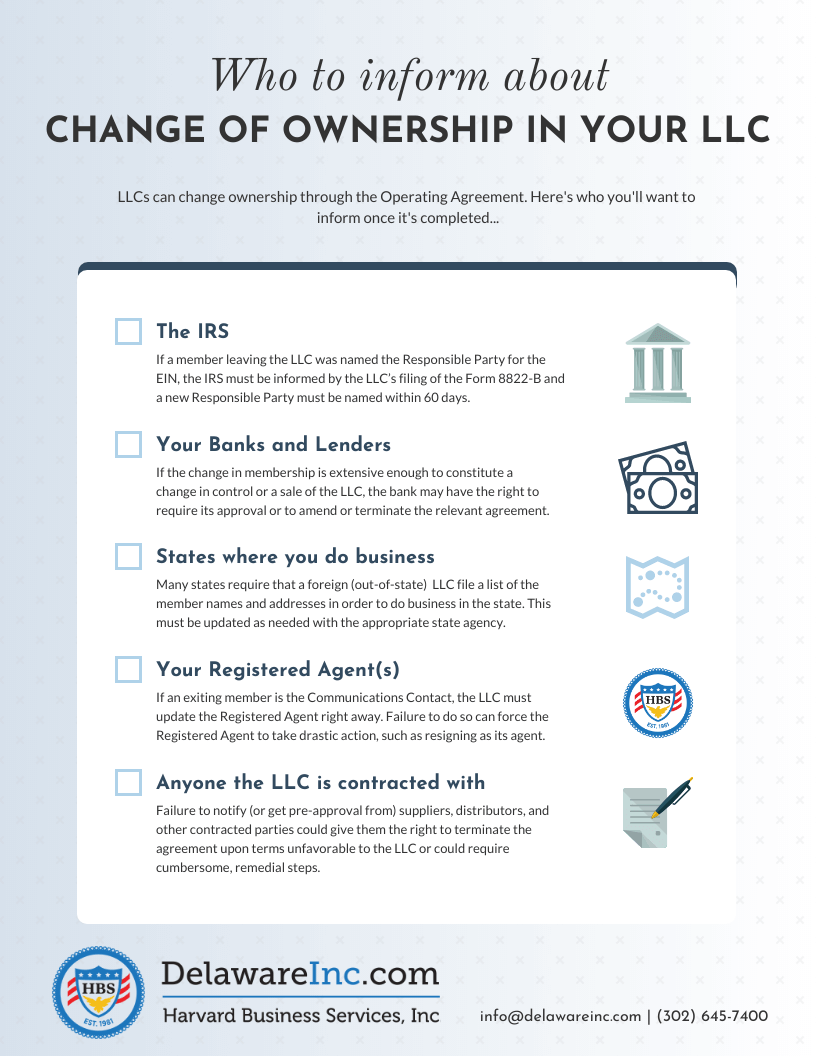

The new owner will need a new Employer ID Number EIN which is given by the IRS. You need to complete Form 8822-B and send it to the IRS to change the EIN Responsible Party for your LLC If the Responsible Party for your LLC has changed youll need to update the IRS as soon as possible as per their requirements. You can usually apply online and have your number within a few hours at most.

In most cases a change of business ownership involves the end of one business and the beginning of another. To change to a more frequent filing status check the appropriate block for sales tax or employer withholding. Use Form 8822-B to notify the Internal Revenue Service if you changed your business mailing address your business location or the identity of your responsible party.

Part I - Individual Change of Name andor Address. The most common forms of business are the sole proprietorship partnership corporation and S corporation. 515 Withholding of Tax on.

Report withheld tax on payments or distributions made to nonresident alien individuals foreign partnerships or foreign corporations to the extent these payments or distributions constitute gross income from sources within the United States that is not effectively connected with a US. Business Information Change Form For faster services make these changes online at dorwagovchange Form BLS 700 160 To ask about the availability of this publication in an alternate format for the visually impaired please call 360-705-6705. Also any entities that change their address or identity of their responsible party must file Form 8822-B whether or not they are engaged in a trade or business.

REV-1869 -- Malt Beverage Account Registration. Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA. However whether an asset or equity sale the seller will need to report gain or loss on the sale of the business assets or equity on the sellers.

ANY liabilities of the LLC remain with the LLC even ones you are not aware. The notification must be signed by the business owner or authorized representative. A change in ownership whereby the LLC changes from a multi-member LLC to a single-member LLC may change how the LLC is taxed by the IRS.

REV-1705 R -- Tax Account Information ChangeCorrection Form. 1545-0123 Name of partnership. The same thing applies to changing a sole proprietorship to a partnership corporation or LLC.

REV-1840 -- Hotel Booking Agent Registration Form. If you are filing a current year return mark the appropriate name change box of the Form 1120 type you are using. Number street and room or suite no.

When beginning a business you must decide what form of business entity to establish. Without knowing all the details of your business sale we cannot confirm that you and the buyer need to file Form 8594 with the IRS to report the sale. Report of a Sale or Exchange of Certain Partnership Interests.

CHANGE OF NAME ADDRESS BUSINESS LOCATION. Any dramatic changes to ownership organizational structure or business status such as converting a sole proprietorship to a partnership require a new EIN application. If you face a more complicated situation you may have to apply via a mail-in form.

Employer identification number. For the latest information. With the change of ownership you have now become the Responsible Person and are obligated to notify the IRS on Form 8822-B within 60 days of the change.

3 New ownership means documents to register the new business with the state. If you sell your business the new owner will need a unique EIN number. REV-1605 -- Names of Corporate Officers Coupon and Instructions.

If you need a new EIN due to an ownership change you want to obtain the number as quickly as possible. Social Security Number 4a.

What Is Form 941 And How Do I File It Ask Gusto

What Is Form 941 And How Do I File It Ask Gusto

Form 8822 Fill Out And Sign Printable Pdf Template Signnow

Form 8822 Fill Out And Sign Printable Pdf Template Signnow

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

What Is Irs Form 8822 B Harvard Business Services

What Is Irs Form 8822 B Harvard Business Services

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

How To Apply For An Ein For Your Llc Online Step By Step Llc University

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Irs Releases Draft Versions Of New K2 And K3 Partnership Forms Cpa Practice Advisor

Irs Releases Draft Versions Of New K2 And K3 Partnership Forms Cpa Practice Advisor

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Https Www1 Nyc Gov Assets Hpd Downloads Pdfs Services Change 0f Ownership Package Pdf

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

3 Tips To Capture Big Write Offs For Business Assets Cpa Practice Advisor

3 Tips To Capture Big Write Offs For Business Assets Cpa Practice Advisor

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos