1099 Contractor Mileage Reimbursement

To have the reimbursement not hit their tax reporting first they must have provided substantial documentation and the payer must then make a full accounting of it on the business return. Mileage reimbursement rates are not just for people who operate vehicles for work.

How To File Taxes With A 1099 K Or 1099 Misc Filing Taxes Tax Help Business Tax

How To File Taxes With A 1099 K Or 1099 Misc Filing Taxes Tax Help Business Tax

The Contractor should have a policy that requires its employees to use sound business judgment in both determining the need for travel as well as in expending Contractor financial resources when travel is necessary.

1099 contractor mileage reimbursement. Companies I mean ERs that pay contractors 600 or more for services provided during the year must provide the contractor with a Form 1099-MISC by January 31 of the following year. For this reason the IRS has provided some leeway when it comes to what is OK to account for reimbursement. The IRS sets a standard mileage reimbursement rate.

This reimbursement can also be granted to anyone who flies a private aircraft with the current reimbursement rate set at a generous 131. You made the payment to someone who is not your employee. If the contractor keeps them as his expenses then the whole amount you pay him is 1099 reportable View solution in original post 2.

To be able to calculate how many dollars to deduct from your mileage expenses as a whole simply multiply the number of miles driven times the number535. Paid on a reimbursement basis upon submission of the original receipt andor rental agreement. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

1099s are intended for the payment of services of 600 or more. Especially when they are turning oringial receipts. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC.

If the reimbursement is part of your taxable income you can take whatever deductions you would be allowed against that income using schedule C or form 2106 depending on the work you do. Rather than requiring someone to manually input odometer readings before and after each trip our system calculates the distance between point A and point B to determine mileage. I am an independent contractor and the company reimburses my mileageThis mileage reimbursement will show up on my 1099 incomeCan I deduct this mileage on my schedule C.

The crux of the matter is who has the expense receipts - if you get them then you are reimbursing the expense and it is not 1099 reportable. As mentioned above there should be an accountable plan so that the payer properly picks up the reimbursed expenses. In the event that your client does NOT include those expenses reimbursements on your 1099-MISC.

Payers use Form 1099-MISC Miscellaneous Income or Form 1099-NEC Nonemployee Compensation to. If payment for the reimbursement provided to you is listed in box 7 of Form 1099-MISC you are being treated as a self-employed worker also referred to as an independent contractor. The following guidelines are provided to assist the.

If your client reimburses you for expenses and includes those reimbursements on the 1099-MISC form then simply deduct those expenses on your own tax return. Reimbursements based on the. If the following four conditions are met you must generally report a payment as nonemployee compensation.

Reimbursement will NOT be reported as income on their 1099. If the mileage is a valid business expense and has not passed this test the person deducts the mileage against the 1099-MISC income. For example if you claim to drive 15000 miles for business reasons this is how you would calculate your deductible expenses.

Changes to the scope of a project may trigger additional travel expenses that a contractor would only agree to under certain conditionsone of them being mileage reimbursement. Therefore the reimbursement of expenses should not be reported. For 2020 the federal mileage rate is 0575 cents per mile.

Simplify Independent Contractor Mileage Reimbursement SureMileage is a modern mileage tracking and expense reimbursement solution developed by CompanyMileage. Consequently the reporting burden falls to the contractor. The PSA agreement or contract must include travel or out of pocket costs will be reimbursed up to XXX.

Contractor Travel Reimbursement Guidelines. Anything you pay to a contractor is 1099 income. However I have created two vendors codes mainly for small contractors one for reimbursed expenses like air travel and hotels not 1099 and another for their fees.

Irs Updates Standard Mileage Rates For 2021 Small Business Trends Small Business Trends Business Trends Irs

Irs Updates Standard Mileage Rates For 2021 Small Business Trends Small Business Trends Business Trends Irs

Buy A Payslip Or P60 Payroll Template Templates Words

Buy A Payslip Or P60 Payroll Template Templates Words

Monthly Travel Spending Tracking Sheet Expense Tracker Business Travel Medical Insurance

Monthly Travel Spending Tracking Sheet Expense Tracker Business Travel Medical Insurance

Free Accounting Tool For Independent Contractors Accounting Independent Contractor Job Board

Free Accounting Tool For Independent Contractors Accounting Independent Contractor Job Board

What To Know About Independent Contractor Mileage Reimbursement

What To Know About Independent Contractor Mileage Reimbursement

Sample Contractor Invoice Templates Invoice Example Invoice Template Invoice Template Word

Sample Contractor Invoice Templates Invoice Example Invoice Template Invoice Template Word

Family Travel Expense Tracker Excel Report Template Business Template Templates

Family Travel Expense Tracker Excel Report Template Business Template Templates

Equipment Checkout Form Template Awesome Equipment Checkout Form Template Excel Inspection Log Templates Concert Ticket Template Contract Template

Equipment Checkout Form Template Awesome Equipment Checkout Form Template Excel Inspection Log Templates Concert Ticket Template Contract Template

Reimbursement Request Form Template Inspirational Expense Claim Form Template For Excel Excel Templates Invoice Template Templates

Reimbursement Request Form Template Inspirational Expense Claim Form Template For Excel Excel Templates Invoice Template Templates

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Pin On 100 Examples Online Form Templates

Pin On 100 Examples Online Form Templates

Reimbursement Request Form Template Beautiful Blank And Easy To Use Employee Expense Reimbursement Funeral Program Template Templates Email Newsletter Template

Reimbursement Request Form Template Beautiful Blank And Easy To Use Employee Expense Reimbursement Funeral Program Template Templates Email Newsletter Template

Business Mileage The Holy Grail Of Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions

Pin By Jr Tax On Taxation In 2021 Tax Return

Pin By Jr Tax On Taxation In 2021 Tax Return

Pin By Jr Tax On Taxation In 2021 Tax Return

Pin By Jr Tax On Taxation In 2021 Tax Return

Information Technology Risk Assessment Template Elegant Simple Fire Risk Assessment Template Email List Template Questionnaire Template Information Technology

Information Technology Risk Assessment Template Elegant Simple Fire Risk Assessment Template Email List Template Questionnaire Template Information Technology

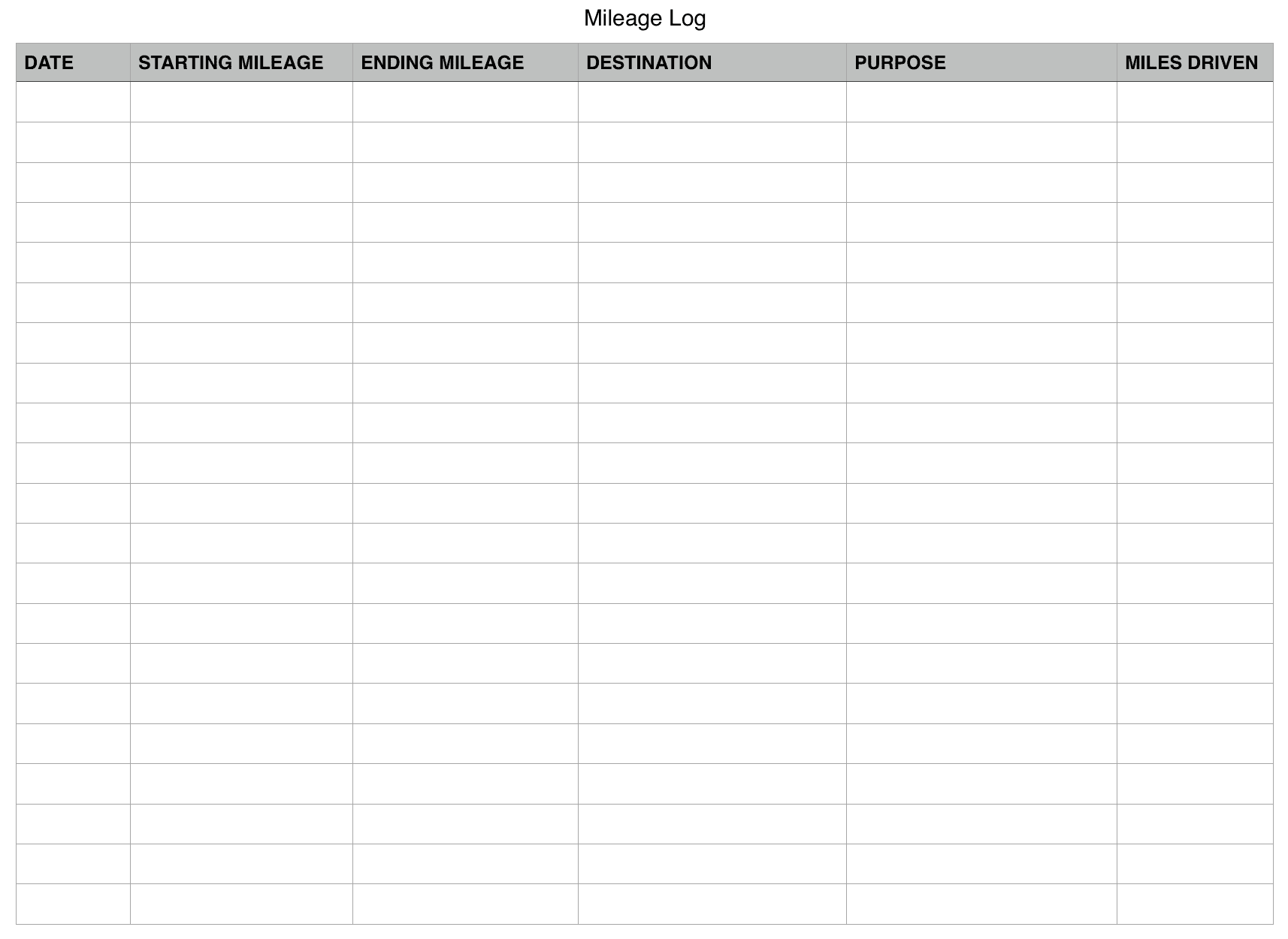

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Excel Templates

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Excel Templates

Contractor Invoice Template Excel New Construction Invoice Template 5 Contractor Invoices Invoice Template Invoicing Software Invoice Template Word

Contractor Invoice Template Excel New Construction Invoice Template 5 Contractor Invoices Invoice Template Invoicing Software Invoice Template Word

What You Need On Your Mileage Log

What You Need On Your Mileage Log