Do You Send A 1099 For Credit Card Payments

Im trying to do my taxes sooner than later because im buying my first house soon and need to get it done and also get what ever refund comes to help with the downpaymentclosing costs. Further if you accept payments from a third party settlement organization you should receive a Form 1099-K only if.

Understanding The 1099 K Gusto

Understanding The 1099 K Gusto

I was paid about 5666 for freelancing but the company never sent a 1099 I contacted their CFO the other day but never heard back.

Do you send a 1099 for credit card payments. The IRS then requires the borrower to report that amount on a tax return as income and its often an unpleasant surprise. In this case if youve paid by credit card you dont have to do 1099 for them. If you are paying all of your bills strictly by credit card or say PayPal you should UNDER NO CIRCUMSTANCES be issuing a 1099-NEC to any of the freelancers you hire.

Do you want them to appear on the report for some other reason. If you are set up to accept payment cards as a form of payment you will receive a Form 1099-K for the gross amount of the proceeds for the goods or services purchased from you through the use of a payment card in a calendar year. The answer is.

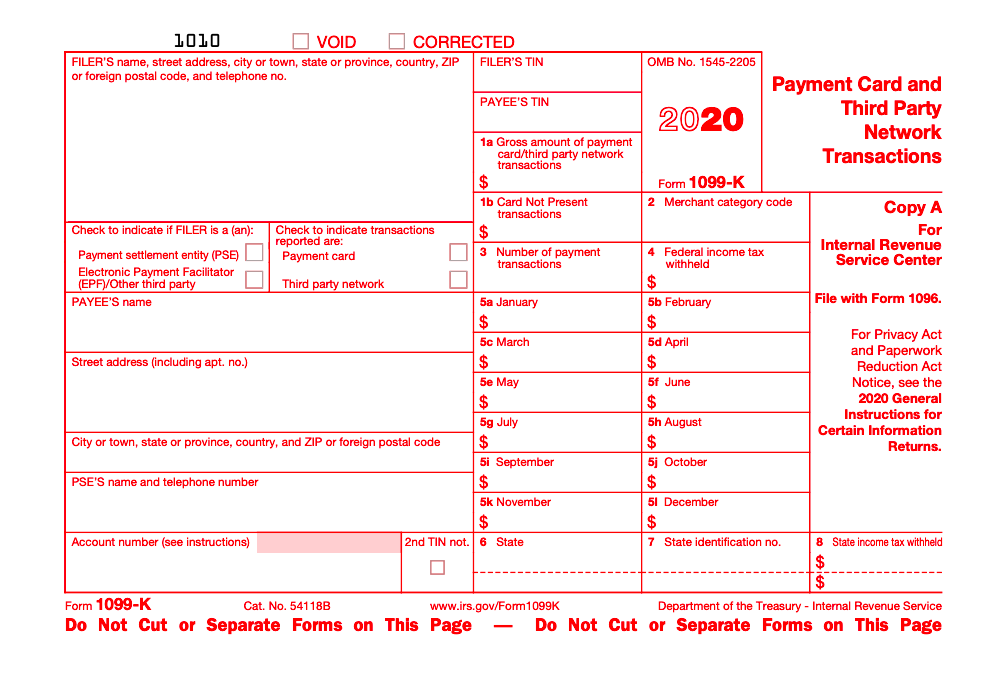

See the separate Instructions for Form 1099-K. When both a merchant acquiring entity and a processor have a contractual obligation to pay the merchant the entity that submits the instructions to transfer funds to the merchants account is responsible for preparing and furnishing a payee statement to the participating payee and filing the Form 1099-K with the IRS. For more information read this article.

Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on Form1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-. And plenty of taxpayers have been getting 1099-Cs for debt thats many years or even decades old. Credit card payments for anyone are EXCLUDED from 1099 - you never have to issue a 1099 for cc payments unless you are the credit card company.

If payments are reportable on both a Form 1099-MISC and 1099-K they are only reportable on a 1099-K According to IRS guidance on form 1099-K. Copies of the form are sent to both the business and to the IRS. The 1099-K is issued by third party payment processing companies such as creditdebit card processors PayPal etc.

If you issued one to a lawyer you could be fined for issuing a fraudulent 1099. Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-NEC. Unfortunately there are many reports of companies still doing exactly that.

If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to. The Credit Card Company will report the 1099-k to them. The IRS 1099-MISC instructions in the section titled Form 1099-K state Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC.

Consumer advocates argue that under IRS guidelines creditors should send a 1099-C three years after there has been no activity on the debt but they acknowledge the rules are unclear. Understanding Your Form 1099-K. Yes you have to issue your contractors a 1099-MISC for your payments to them if you paid them more than 600.

1099-MISC forms issued should include only payments made by cash check wire transfer electronic check ACH online bill pay bank to bank only or direct deposit. Lawyers are exempt from receiving 1099. How to File 1099s.

Vendors paid only with a credit card should not receive a 1099 and since credit card data wont be included on the report or the 1099 form they dont appear. Do you have to issue a 1099-Misc for a payment made with a credit card. Credit card payments are reported using Form 1099-K.

They may simply not have told you what the rules were to begin with preying on your trust. How you paid them does not remove the requirement to file Form 1099-MISC. Details of Credit Card and Merchant Payment Reporting Banks and other payment settlement services must report gross annual receipts for each merchant.

If this happens to you first try calling the creditor. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099. Who reports payment card transactions when a payment settlement entity contracts with a third party such as an electronic payment.

If a debt is forgiven or canceled the IRS requires lenders to issue a 1099-C tax form to the borrower to show the amount of debt not paid. 6 exceptions to paying tax on forgiven debt 1099-C. You are not required to send a 1099 form to independent contractors such as freelancers or to other unincorporated businesses such as LLCs if you paid them via PayPal or credit card.

Follow this 1099 Decision Tree to help you decide who you need to supply a form to. That is the case even if you paid the recipient more than 600 last year. For payments to vendors and contractors.

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Ms Excel Printable Credit Card Log Templates Excel Templates Credit Card Statement Excel Spreadsheets Templates Spreadsheet Template

Ms Excel Printable Credit Card Log Templates Excel Templates Credit Card Statement Excel Spreadsheets Templates Spreadsheet Template

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Pin On Apartment Kitchen Decor Themes Modern

Pin On Apartment Kitchen Decor Themes Modern

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice