Form 1099 Misc Box 7 2020

Crop insurance proceeds are reported in. If your 1099-MISC is from 2020 and box 7 is checked but there is no other information on the form then the issuer most likely also sent you a 1099-NEC that reports your payments.

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

The 1099-MISC box 7 was also used to report fees commissions prizes awards and other forms of compensation for services.

Form 1099 misc box 7 2020. Steps for 1099 Corrections. Depending on the agreement this form was also used to report golden parachute payments. Just enter one total income in.

New W-9 Forms are a good way to avoid incorrect filings. 1099 Tax Guide - Know all about Form 1099 MISC Box 10 and Box 14. For reporting non-employee payments theres no automatic 30-day.

From what I read the taxpayer should have had that amount reported in Box 1 of a 1099-NEC also and there should be an additional tax on compensation received from a nonqualified deferred compensation. IRS 1099 form critical due dates in 2018 tax year. Form 1099 MISC Box 15a and Box 15b Nonqualified Section 409A Income.

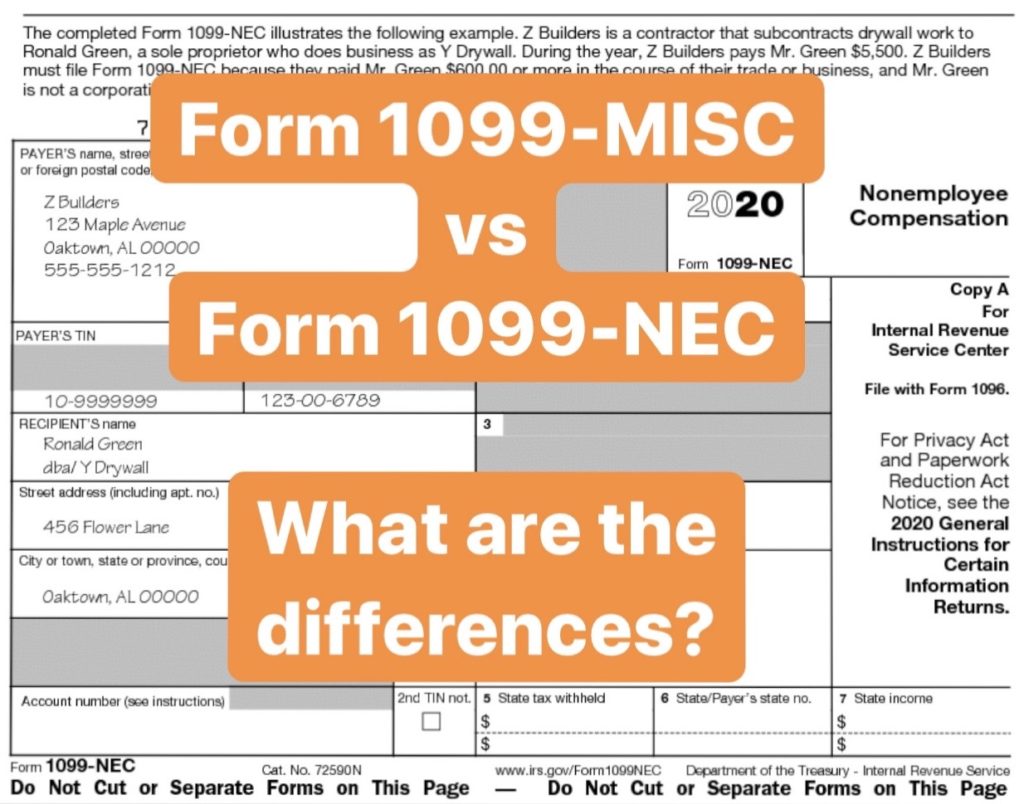

Report rents from real estate on Schedule E Form 1040. Form 1099-NEC was an active form until 1982 it is now returning to the spotlight for tax year 2020. The non employee compensation is reported to the IRS with the help of 1099 NEC Tax Form.

If you cannot get this form corrected attach an explanation to your tax return and report your income correctly. Box 7 where nonemployee compensation was once reported now hosts the check box for direct sales of 5000 or more. Not a surprise if you have updated the program recently and it is not like the online program yet.

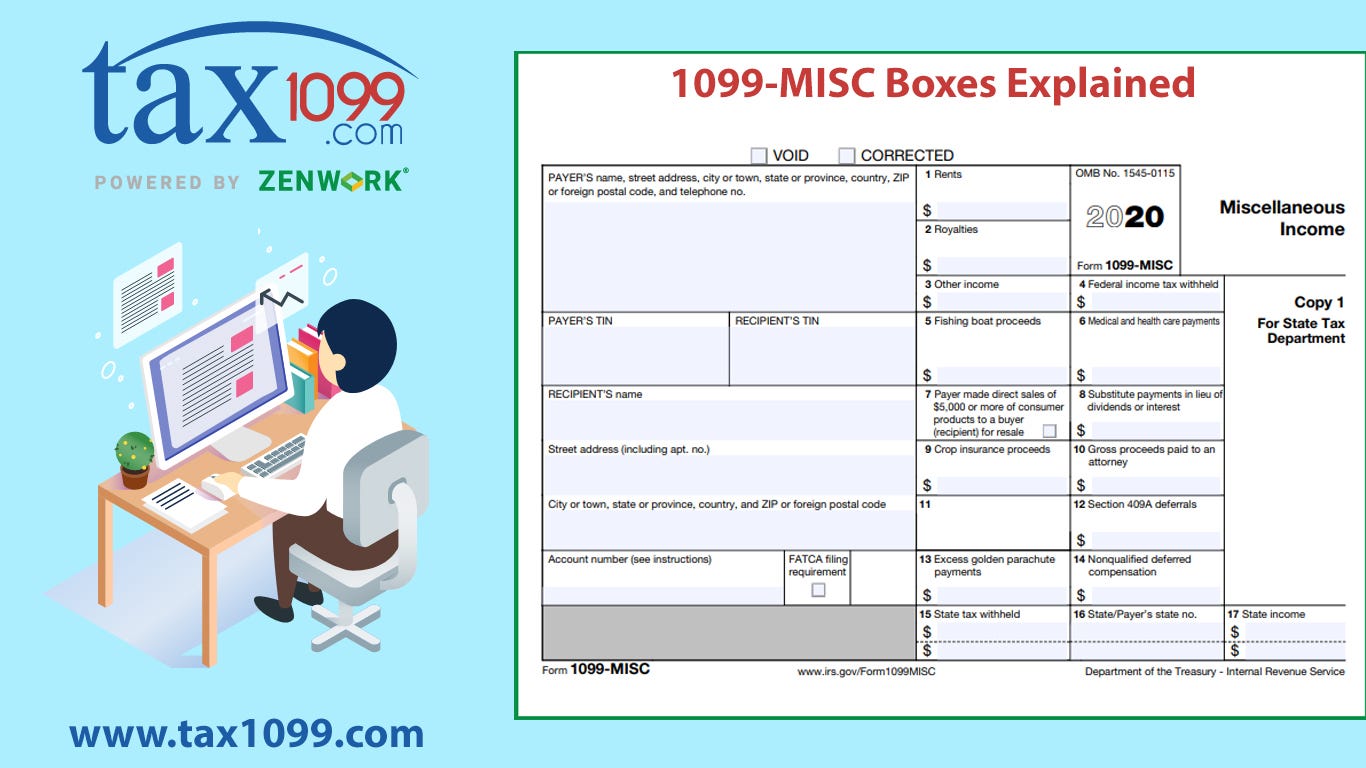

The 1099 MISC Box 7 is reported using 1099 NEC Online Form. In 2020 Box 7 on Form 1099-MISC turned into Payer made direct sales of 5000 or more of consumer products to a buyer recipient for resale and nonemployee compensation is reported on Form 1099-NEC instead. And again you do NOT need that form at all.

If you filed 1099-MISC with only Box 7 in the past you should most likely choose Box 1 - Nonemployee Compensation on the 1099-NEC. If this form is incorrect or has been issued in error contact the payer. Again report nonemployee compensation on Form 1099-NEC.

You can enter your form in TurboTax. Beginning in 2020 box 7 will be used to indicate the payer made direct sales of 5000 or more of consumer products to a buyer. Changes in the reporting of income and the forms box numbers are listed below.

If you cannot get this form corrected attach an explanation to your tax return and report your information correctly. As part of every real estate transaction where commissions are distributed the IRS requires listing brokers to complete Form 1099-MISC if cooperative commission in excess of 600 is paid to an individual who is not an employee of the brokerage firm. Report rents from real estate on Schedule E Form 1040 or 1040-SR.

All the filers who are going report the independent contractor income used 1099 MISC Form from the previous year. The IRS relaunched 1099-NEC because of the confusion in the deadline to file 1099-MISC with nonemployee compensation. Form 1099 Online 2020 effectively pulls out some of the details we used to report in Box 7 of the 1099-MISC.

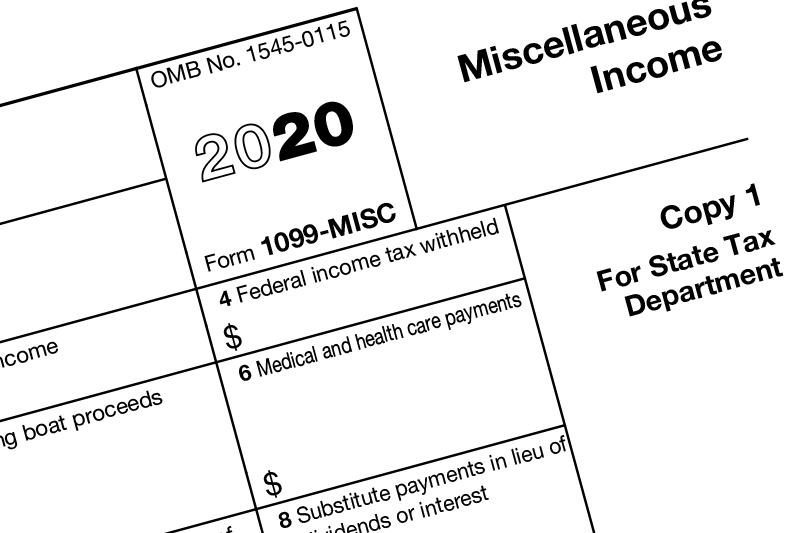

This is the most common situation and the only box most businesses will need to select for payment types. There is an income tab and a place to put in the 1099-MISC but nothing from that box 14 flowed over onto the Form 1040. The most significant change in 1099 MISC Form for the 2020 tax year is the break out of non-employee compensation from box 7 to new Form.

Box 7 of 1099 MISC in Turbot Tax 2020 Home Business is missing. But from 2020 tax year the filers need to separately File IRS Form 1099 MISC and also 1099 NEC Form. By requesting new W-9s from their service providers firms can make things easier.

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. Compared to previous years in the current year the taxpayers can easily report non-employee compensation through revived 1099 NEC Tax Form. If this form is incorrect or has been issued in error contact the payer.

Report Inappropriate Content. Due Dates for Filing LLC and Partnership Tax Returns in 2019. And if the issuer sent you a 1099-MISC with your payment listed in another box thats ok.

The new form resolves some administrative problems that arose from the PATH Act approved in 2015. You may simply perform services as a non. Payer made direct sales of 5000 or more checkbox in box 7.

If the business was established newly and doesnt have an idea about Printable 1099-Misc Forms then IRS provides a one-month extension to file the Form 1099-Misc. Youll also find that the boxes have been rearranged on the 1099-MISC. Before the 2020 tax year Free Fillable 1099-Misc Form Box 7 is used for reporting non-employee payments.

What is reported on 1099-NEC. Until 2015 the deadline to file 1099 MISC with nonemployee compensation and other miscellaneous payments was February 28. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor.

Required Reporting On Cooperative Commissions In Real. Just enter your 1099-NEC as you would normally theres nothing you need to do with this blank 1099-MISC. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

How to Correct a 1099 Form.

1099 Misc 2020 Public Documents 1099 Pro Wiki

1099 Misc 2020 Public Documents 1099 Pro Wiki

How To Read 2020 Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

How To Read 2020 Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Major Changes To File Form 1099 Misc Box 7 In 2020

Major Changes To File Form 1099 Misc Box 7 In 2020

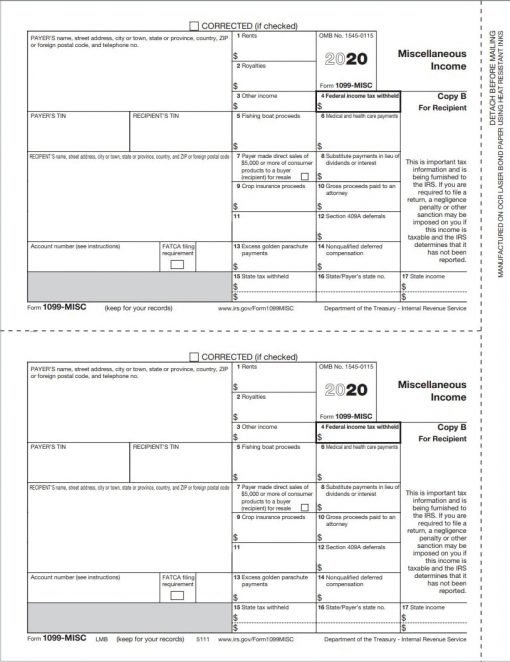

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms