Are Small Business Grants Taxable Income

While grants to small businesses would appear to fit under the general welfare doctrine the IRS has ruled that grants to a business generally do not qualify for the general welfare exclusion because they are not based upon individual or family needs. Online Tax Help Online resources for small business and self-employed taxpayers.

Small Business Owner How To Save A Ton On This Year S Taxes In 2020 Investing Financial Fitness Good Books

Small Business Owner How To Save A Ton On This Year S Taxes In 2020 Investing Financial Fitness Good Books

Additionally qualifying expenses can be written off to lower your tax liability.

Are small business grants taxable income. Grants Are Income All income from whatever source derived is taxable income unless the tax law provides an exception1 Since a government grant is income it is taxable unless otherwise provided by law. Now funds from an EIDL Advance are not reported as taxable business income. Online resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million.

Generally it is better to expect that the majority of grants are counted as taxable income. This simply entails that you will be expected to pay taxes on those funds. State and local grants to businesses funded outside the CARES Act are also taxable income to the businesses.

Small Business and Self-Employed Tax Center. You can enter it under your Business income in Other Income. Small Business Administration SBA Grants and Loans Federal.

SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such. Emergency financial support such as the Self-Employment Income Support Scheme SEISS and Small Business Grant Fund SBGF are subject to Income Tax and Self-Employed National Insurance. Economic Injury Disaster Loan EIDL advances and grants are tax-free at the federal level.

Includes info about PPP for the self-employed and small businesses EIDL loans and if loan proceeds are taxable. Are payments from the Were All In Small Business Grant Phase 2 program considered taxable income. COVID-19-Related Grants to Individuals.

Filing and Paying Business Taxes. However a grant made by the government of a federally recognized Indian tribe to a member to expand an Indian-owned business on or near reservations is excluded from the members gross income under the general welfare exclusion. Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable.

However this decision was reversed under the Consolidated Appropriations Act. The bad news is that federal state and local grants may be taxable income to the grantee. Are payments from the Were All In Small Business Grant Phase 2 program considered taxable income.

1 2021 and through Dec. According to the New Jersey Division of Taxation any payments that the SBA makes for principal interest and fees are considered to be cancellation of debt COD. Small Business Grants.

61 of the Internal Revenue Code unless an exemption applies. The IRS has made clear that these state and local grants to businesses are taxable income. 31 2021 small businesses with fewer than 500 employees that experienced a quarterly revenue decline of 20 previously 50 year-over-year can claim a payroll tax credit for 70 of qualified wages up to 10000 per employee per quarter.

The grant should replace income lost and so hopefully tax will be payable at no more than their normal marginal rate of tax. In most instances grant funds are considered a taxable income on your federal tax return. Thus for example pandemic rental assistance is not taxable income.

But Congress has acted to make a few types of COVID-19-related government grants tax-free as described below. Details about the Paycheck Protection Program PPP2 EIDL grants and more under the stimulus bill enacted in December 2020. As a rule government grants to help individuals after a disaster such as the COVID-19 pandemic are not taxable income under the general welfare exclusion.

Congress recently changed the tax code to make clear that any contribution by a governmental entity to the corporation is taxable. 61 of the Internal Revenue Code unless an exemption applies. Income from the program is included in federal income pursuant to sec.

EIDL Emergency Advances Are Tax-Free. Then enter a description SBIR Grant reported on 1099-G and the amount. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable.

However many businesses are not eligible for cash-basis accounting including companies LLPs and unincorporated businesses with turnover of 150000 or more to name a few. Where do I enter a taxable grant reported on 1099-G as business and not as private income so that self-employment tax is paid on this grant. The financial impact of a grant in tax time depends on several factors including your business structure.

Income from the program is included in federal income pursuant to sec. Initially funds from EIDL Advances were to be reported as taxable income.

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Smart Money

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Smart Money

2018 Last Minute Year End General Business Deductions Deduction Tax Deductions Tax Preparation

2018 Last Minute Year End General Business Deductions Deduction Tax Deductions Tax Preparation

How To Catch Up On Your Bookkeeping For Etsy Sellers Small Business Finance Bookkeeping Starting An Etsy Business

How To Catch Up On Your Bookkeeping For Etsy Sellers Small Business Finance Bookkeeping Starting An Etsy Business

12 Types Of Income You Must Pay Taxes On And 5 The Irs Can T Touch Irs Paying Taxes Business Grants

12 Types Of Income You Must Pay Taxes On And 5 The Irs Can T Touch Irs Paying Taxes Business Grants

Write It Off Deduct It The A To Z Guide To Tax Deductions For Home Based Businesses Home Based Business Tax Deductions Business Tax

Write It Off Deduct It The A To Z Guide To Tax Deductions For Home Based Businesses Home Based Business Tax Deductions Business Tax

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

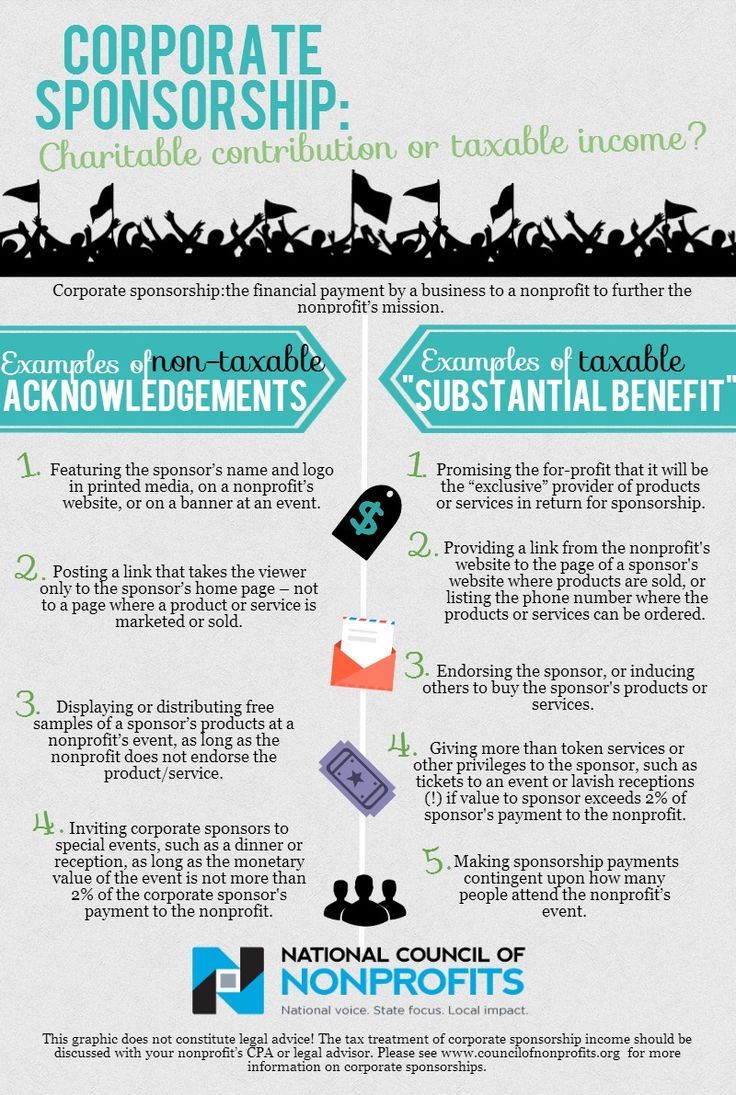

Corporate Sponsorship Charitable Contribution Or Taxable Income Sponsorship Nonprofit Cha Sponsorship Proposal Charitable Contributions Sponsorship Levels

Corporate Sponsorship Charitable Contribution Or Taxable Income Sponsorship Nonprofit Cha Sponsorship Proposal Charitable Contributions Sponsorship Levels

Is Child Support Considered Taxable Income Single Mom Money Single Mom Budget Health Insurance Plans

Is Child Support Considered Taxable Income Single Mom Money Single Mom Budget Health Insurance Plans

Easy To Use Accounting Software For Freelancers Bigez Com In 2020 Small Business Accounting Software Small Business Accounting Accounting Software

Easy To Use Accounting Software For Freelancers Bigez Com In 2020 Small Business Accounting Software Small Business Accounting Accounting Software

Small Businesses Don T Overlook These Tax Write Offs Small Business Tax Business Tax Tax Write Offs

Small Businesses Don T Overlook These Tax Write Offs Small Business Tax Business Tax Tax Write Offs

Tax Write Off For Small Business Owners Business Tax Small Business Tax Small Business Owner

Tax Write Off For Small Business Owners Business Tax Small Business Tax Small Business Owner

This Is A Short List Of The Taxes Your Business Could Be Liable For Tax Business Types Of Taxes

This Is A Short List Of The Taxes Your Business Could Be Liable For Tax Business Types Of Taxes

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

3 Monthly Check Ins To Make Your Taxes Easier With Grace Gold Small Business Tax Small Business Accounting Business Tax

3 Monthly Check Ins To Make Your Taxes Easier With Grace Gold Small Business Tax Small Business Accounting Business Tax

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Irs Nonprofit Startup Federal Income Tax

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Irs Nonprofit Startup Federal Income Tax

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic