How Much Does It Cost To Become Vat Registered

Company Registration number Immediately. More to the point though if you are becoming a wholesale provider to retail outlets you are going to hit the VAT threshold quite quickly I imagine.

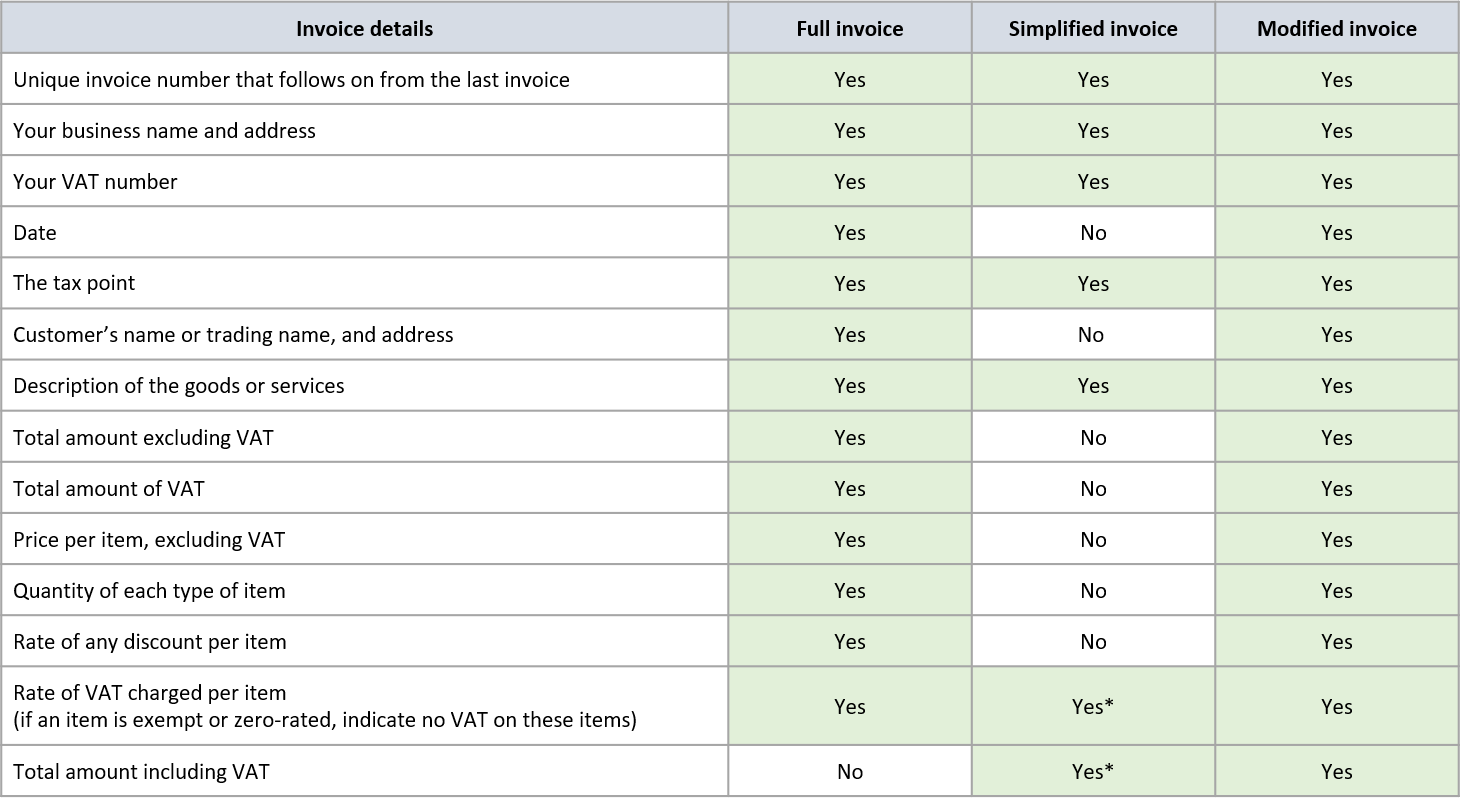

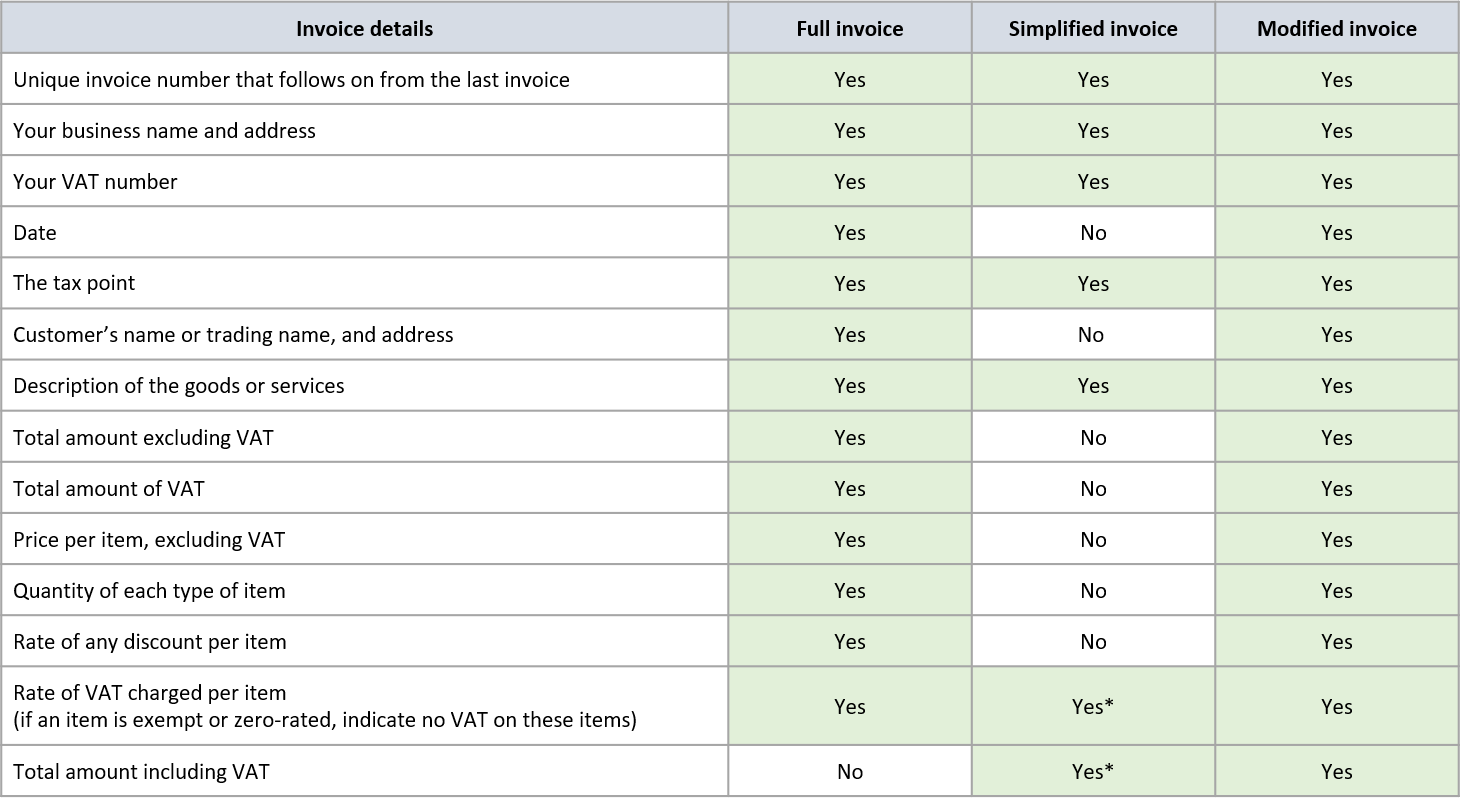

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

The VAT registration threshold in the UK currently stands at 85000.

How much does it cost to become vat registered. The current VAT threshold is 85000 and will be unchanged until 1 April 2022 at the earliest. Theres currently no cost to register for a Vermont sales and use tax license. The preparation and submission of your VAT registration application to HMRC.

The cost to obtain a business license in Washington varies. For example from December 08 the fixed penalty for failing to register for VAT is 4000. If at the start of any 30-day period you believe that your VAT taxable turnover for that 30-day period alone will exceed the VAT registration threshold 85000 for 202021 you need to register immediately.

The Gas Safe registration cost is 228. The costs for the VAT registrations with hellotax depend on the subscription you choose. New VAT taxpayers shall apply for registration as VAT Taxpayers and pay the corresponding registration fee of five hundred pesos P50000 using BIR Form No.

But according to the HMRC You must register for VAT if your annual sales are 67000 or. If however your turnover reaches 85000 or is predicted to do so in the near future then it will become compulsory to register for VAT. Confirmation of your VAT registration number.

You must also keep proper books and accounts otherwise additional penalties may apply. This is your one time application fee which includes one registered gas engineer but there will also be a registration fee to pay as well. VAT - how to register effective date of registration registration thresholds calculate taxable turnover change your details deregister cancel or transfer a VAT registration.

Note that the timeframes above are the official timeframes from SARS but during the Covid Pandemic these timeframes may differ as SARS builds up a backlog each time. R 9990 Once off. Looking at the period 28 July 2019 to 27 July 2020 you can see your VAT taxable turnover will go over 90000 taking you over the 85000 VAT threshold for that 12 months.

Only when your business exceeds a turnover of 85000 do you have to become VAT registered. Last reviewed on 01072020 If your annual turnover is below the threshold you can still voluntarily register for VAT. If you fail to do.

This means youll need to register for VAT by 31 July 2020 and your effective date of registration will be 1 August 2020. So the net cost to the customer remains 100. Theres currently no cost to register for a Virginia sales tax certificate.

VAT is an indirect tax on the consumption of goods and services in the economy. Revenue penalties for VAT fraud or evasion are extremely punitive. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

Get Your VAT Company Now. All prices include VAT which you will be able to claim back if you are registered for VAT. Access to a VAT registration expert to answer your questions.

300 for VAT registration per country. You can find out more about VAT by referring to our detailed guide on VAT. If and when you become VAT registered you will add 20 VAT to your charge so you wil now charge the customer 120 and they will recover the 20 VAT.

One final point I should make is that VAT is a high-risk tax. Here we explore the pros and cons. To be a registered VAT company there is no cost implications.

0 for all VAT. However some companies do decide to register for VAT before they hit this threshold. The decision is totally up to you.

0605 for every separate or distinct establishment or place of business before the start of their business following existing issuances on. Once you are registered for VAT you must then add VAT to your sales invoices at the appropriate rate and complete VAT returns. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million.

Alternatively 1st Formations provides an affordable VAT Registration Service at a cost of 3999 plus VAT. You must register if by the end of any month your total VAT taxable turnover for the last 12 months was over 85000. You have to register within 30 days of the end of the month when you went.

Theres currently no cost to register for a Utah sales and use tax license. 1 ID Documents Passport 2 South African Business Address. If your business annual turnover exceeds this threshold you must register for VAT.

Benefits Of Being Vat Registered Starling Bank

Benefits Of Being Vat Registered Starling Bank

Vat Registration Capital Gains Tax Tax Forms Income Tax

Vat Registration Capital Gains Tax Tax Forms Income Tax

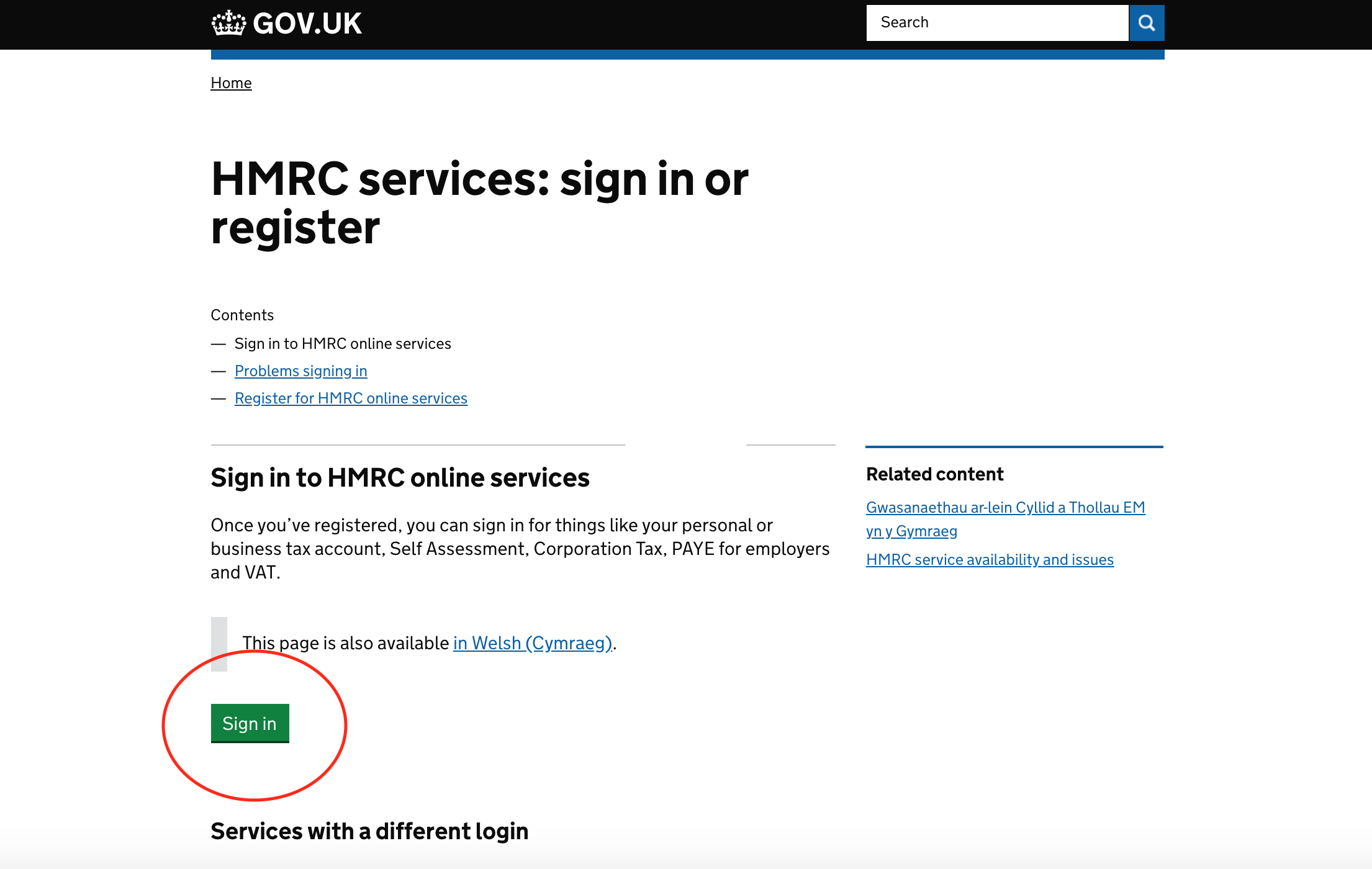

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

U S H International Offering Vat Filing Taxation Services Cheaper Than Market Rates Vat Registration Audit Bookkeepin Service Outsourcing Business Man

U S H International Offering Vat Filing Taxation Services Cheaper Than Market Rates Vat Registration Audit Bookkeepin Service Outsourcing Business Man

Consent Letter Format For Vat Registration Sample Consent Letter Format Consent Letter Lettering

Consent Letter Format For Vat Registration Sample Consent Letter Format Consent Letter Lettering

How To Register For Vat On Efiling

How To Register For Vat On Efiling

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

The 4 Big Benefits Of Being Vat Registered

The 4 Big Benefits Of Being Vat Registered

Register For Vat In Canada Updated For 2021

What Us Based Sellers Need To Know About Vat

What Us Based Sellers Need To Know About Vat

Uber Vat Compliance For Uk Partner Drivers

Uber Vat Compliance For Uk Partner Drivers

Can I Invoice Without A Vat Number Debitoor Invoicing Software

Can I Invoice Without A Vat Number Debitoor Invoicing Software

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

Sales Vat Registration In 2020 Certified Accountant Accounting Start Up

Sales Vat Registration In 2020 Certified Accountant Accounting Start Up

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Are You Based In The Us And Selling Goods To Customers In Europe Here S How To Give Them A Better Buying Experience Selling Online The Outsiders Online

Are You Based In The Us And Selling Goods To Customers In Europe Here S How To Give Them A Better Buying Experience Selling Online The Outsiders Online