Cra Forms Statement Of Business Activities

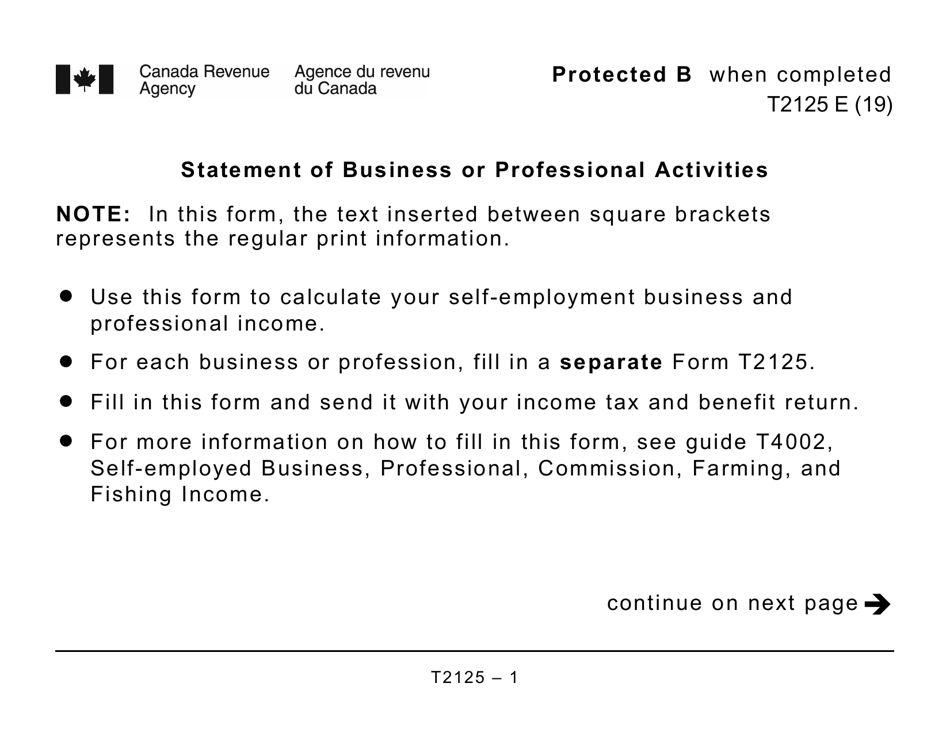

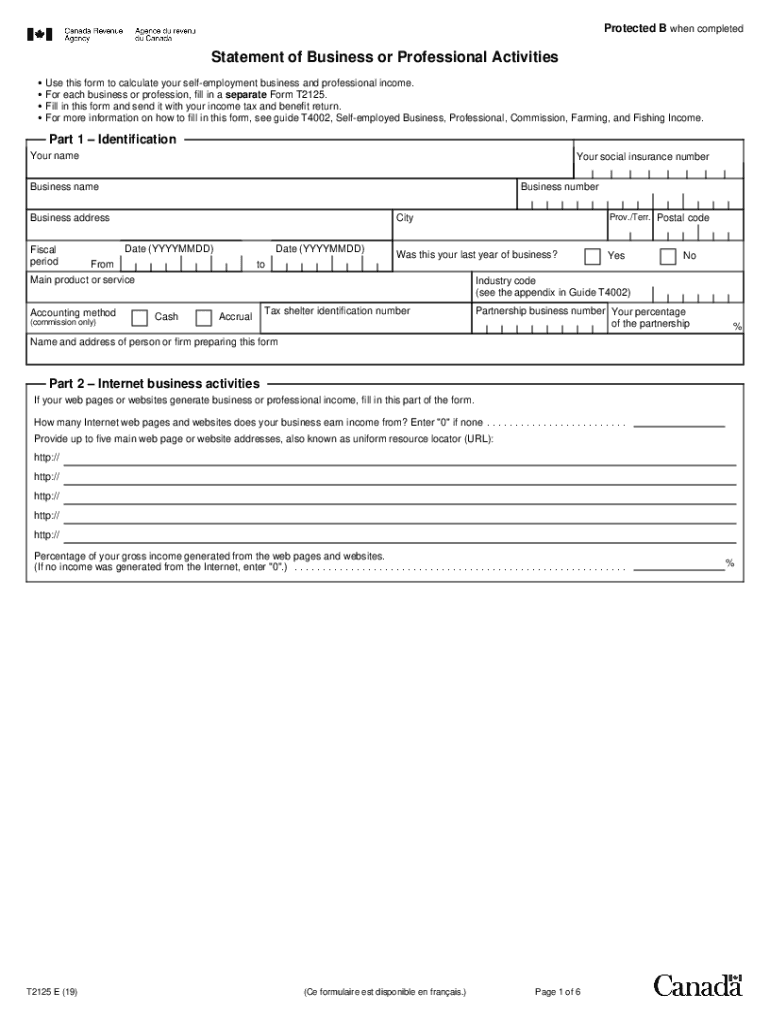

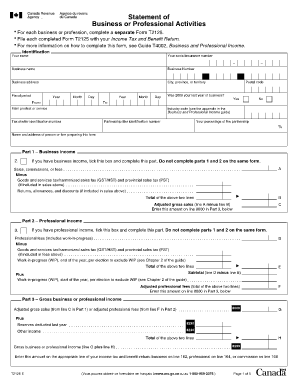

If youre filing a Québec tax return youll also have to complete a TP-80-V. The T2125 form is a versatile reporting tool that allows taxpayers to disclose many facets of their enterprise to the CRA including but not limited to their business income their purported capital cost allowances and elections with respect to losses and work in-progress.

Fill Free Fillable Government Of Canada Pdf Forms

Fill Free Fillable Government Of Canada Pdf Forms

This form can help you calculate your income and expenses for income tax purposes.

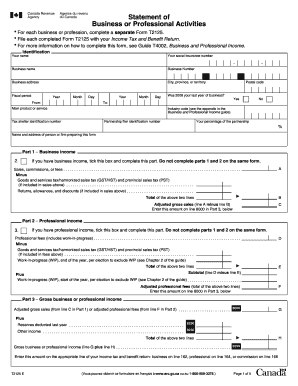

Cra forms statement of business activities. This form combines the two previous forms T2124 Statement of Business Activities and T2032 Statement of Professional Activities. Joint Election in Respect of an Insurance Business Transferred by. Form T2125 Statement of Business or Professional Activities.

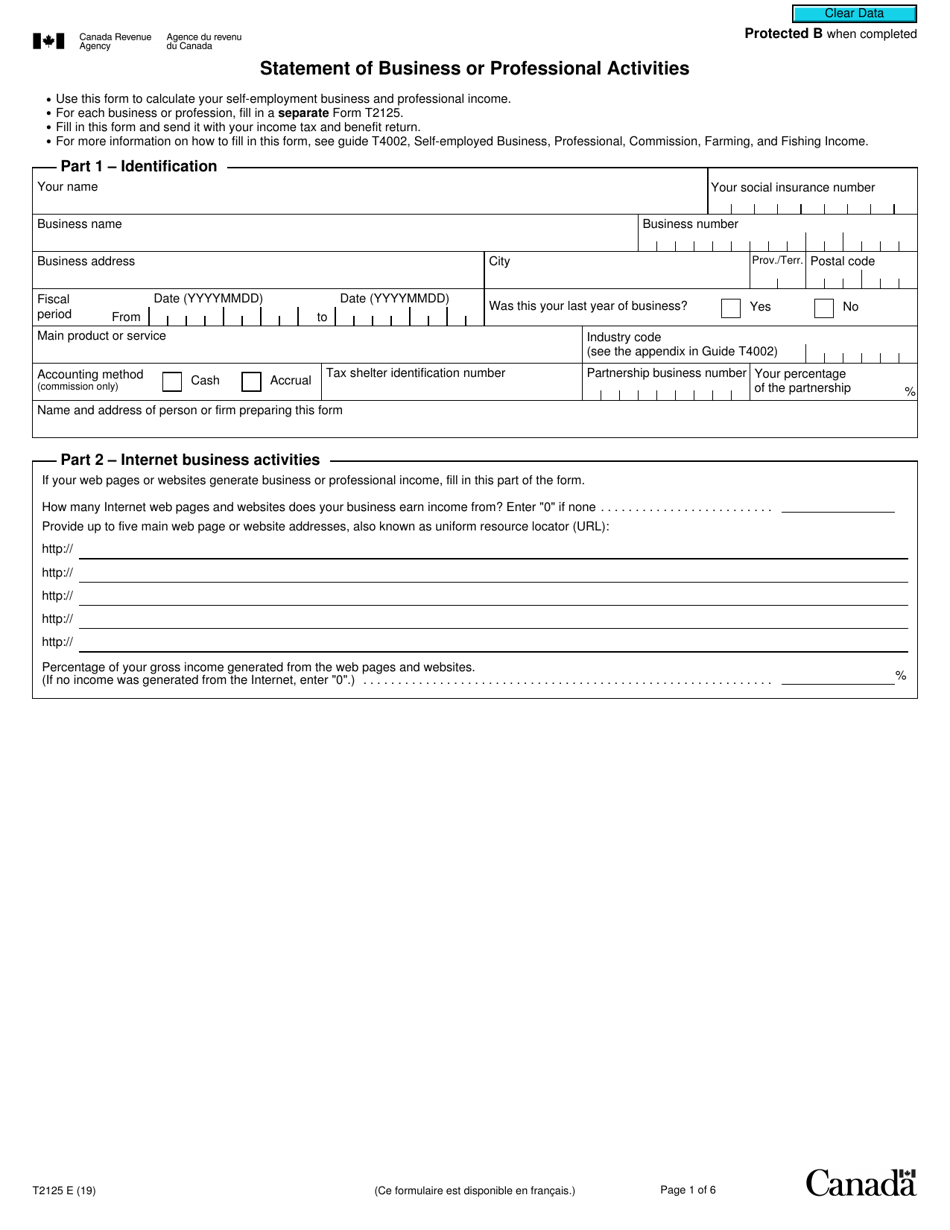

When you arrive at the Statement of Farming Activities page enter your information into the tax software. The Government of Canada has announced a series of tax measures to help support businesses impacted by the COVID-19 virus some of which affect payment deadlines. Note that the examples in this article describe how to enter Canada Revenue Agency CRA automobile expenses on the T1 income individual tax return used by sole proprietors and partnerships.

What is a T2125 Statement of Business or Professional Activities. We encourage you to use it. Typing drawing or uploading one.

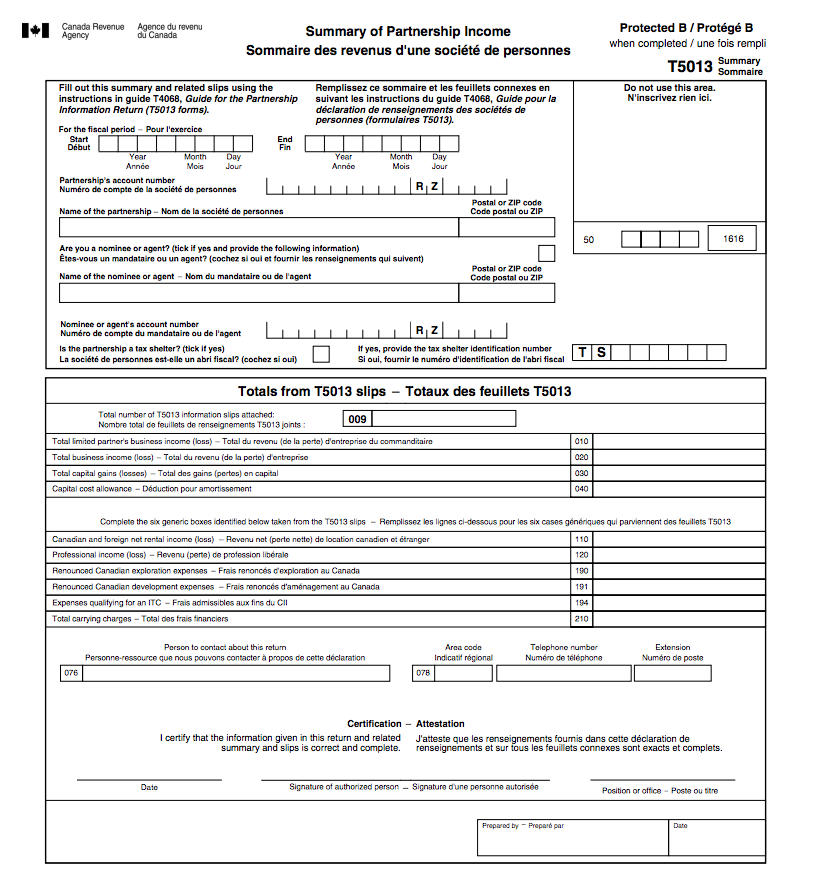

Ensure that the data you fill in CRA Form T2125 - Statement Of Business Or Professional Activities is up-to-date and correct. However we will continue to accept other types of financial statements. Statement of Business or Professional Activities.

Use this form to report either business or. Buildings furniture and equipment that you use in your business or professional activities depreciate over time. If your business is a corporation youll need a T2.

If you have both business and professional income you have to complete a separate Form T2125 for each. T4002 Self-employed Business Professional Commission Farming and Fishing Income 2020. I need help completing this form.

T2125 also called the Statement of Business or Professional Activities is the form that sole proprietors and partnerships use to report the income their business earned in the previous tax year. For best results download and open this. If you received business or professional income as a self-employed person use form T2125.

This form can help you calculate your gross income and your net income loss which. Since you can deduct their cost over a period of time the deduction is called a capital cost allowance CCA. Statement of Fishing Activities.

The T2125 form also called the Statement of Business or Professional Activities is the form that sole proprietors and partnerships use to report the income their business earned in. Use this form to report either business or. You can use Form T2125 Statement of Business or Professional Activities to report your business and professional income and expenses.

You can find the CRA form here. Select the Sign icon and make a digital signature. You will find 3 available alternatives.

This form is used by self-employed farmer or member of farming partnerships to help to calculate the farming income and expenses for income tax purposes. Any company that hires employees must provide the government with a T2200 Declaration of Conditions of Employment. Generally speaking anyone who runs an unincorporated business in Canada is considered a sole proprietor or partner by the CRA.

Calculate your CCA by using chart A of your T2125 form. Business or professional income and expenses in Québec form. Statement of Business Activities.

T2042 Statement of Farming Activities. The form helps you to calculate your net income or loss from business activities which you then report on form T1 for your personal income taxes. Under the BUSINESS AND SELF-EMPLOYMENT INCOME section of the Employment and self-employment page select the checkbox labelled Statement of farming activities T2042 then click Continue.

Form T2125 Statement of Business or Professional Activities. For more information on how to fill in this form see Guide T4002 Self-employed Business Professional Commission Farming and Fishing Income. Statement of Business or Professional Activities Protected B when completed For each business or profession fill in a separate Form T2125.

Include the date to the record using the Date option. Statement of business or professional activities to report your income and expenses for the year. Election for a Disposition of Shares in a Foreign Affiliate.

CRA form T2125 is a form that Canadian taxpayers use to report business and professional income when filing their tax returns. Small business owners who are the sole proprietor of their organization can fill out Form T2125. Election for Gains on Shares of a Corporation Becoming Public.

Automobile expenses are included as part of the business expenses on Form T2125 Statement of Business or Professional Activities. The form allows you to keep track of the CCA from year to year. This form combines the two previous forms T2124 Statement of Business Activities and T2032 Statement of Professional Activities.

Statement of Business or Professional Activities.

Form T2125 Download Printable Pdf Or Fill Online Statement Of Business Or Professional Activities Large Print Canada Templateroller

Form T2125 Download Printable Pdf Or Fill Online Statement Of Business Or Professional Activities Large Print Canada Templateroller

Form T2125 Download Fillable Pdf Or Fill Online Statement Of Business Or Professional Activities Canada Templateroller

Form T2125 Download Fillable Pdf Or Fill Online Statement Of Business Or Professional Activities Canada Templateroller

Business Vehicle Expenses Focus On Tax

Business Vehicle Expenses Focus On Tax

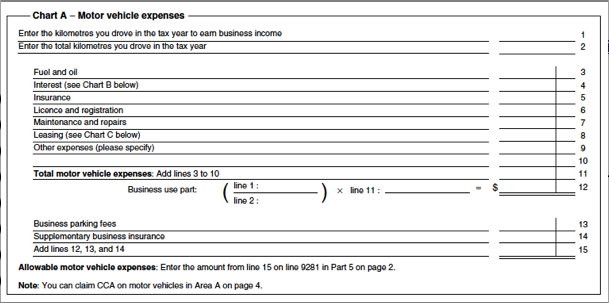

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

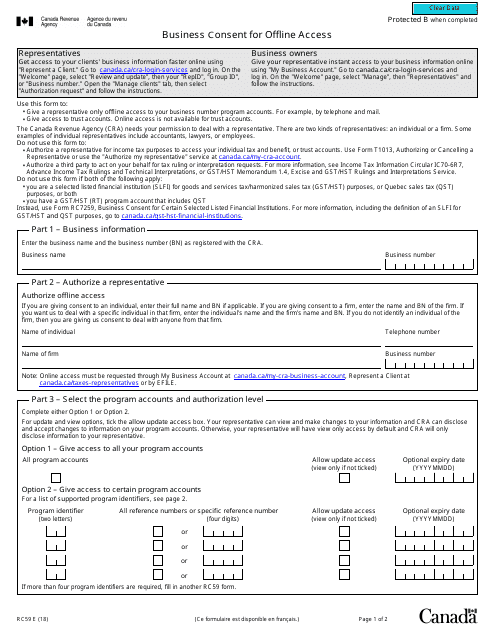

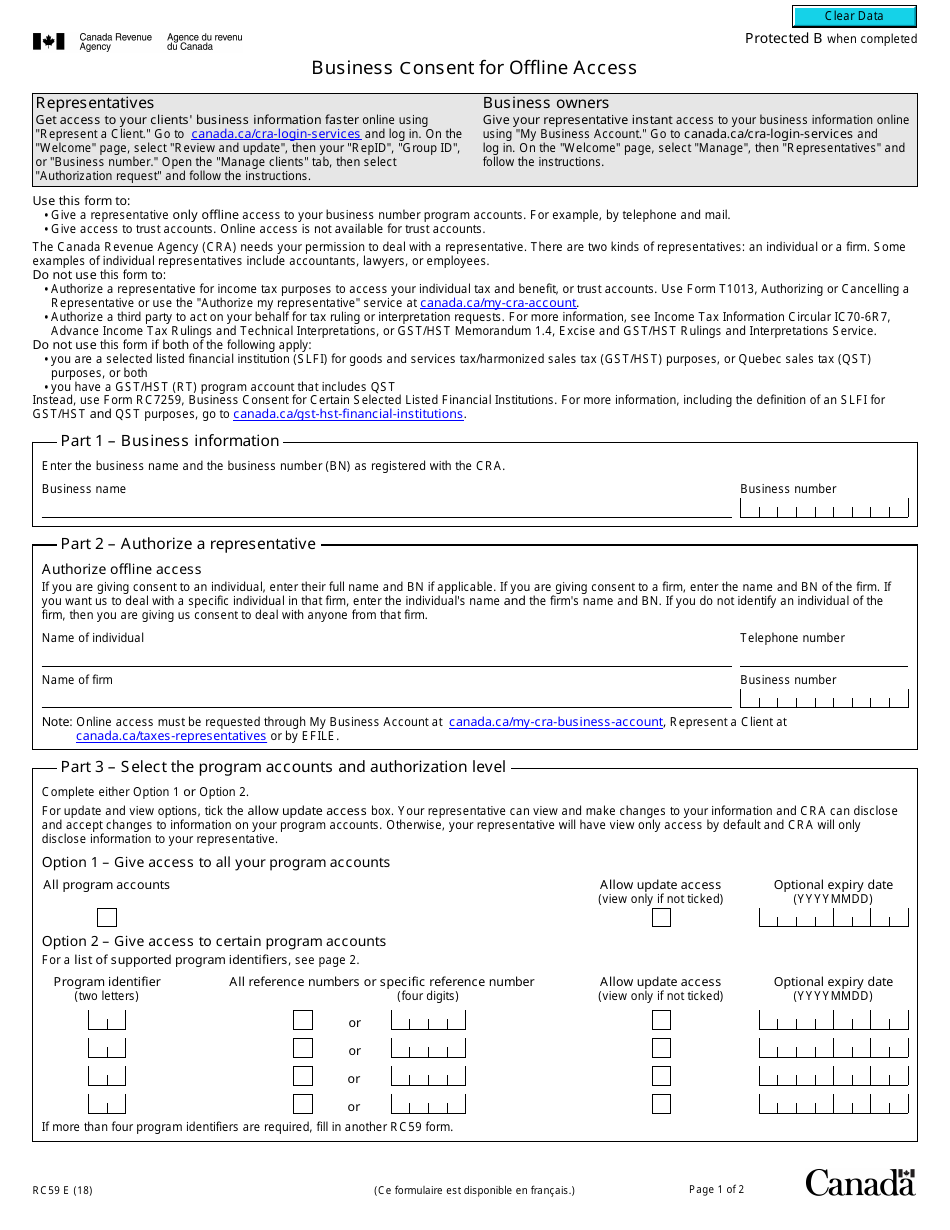

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

Fill Free Fillable Government Of Canada Pdf Forms

Fill Free Fillable Government Of Canada Pdf Forms

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

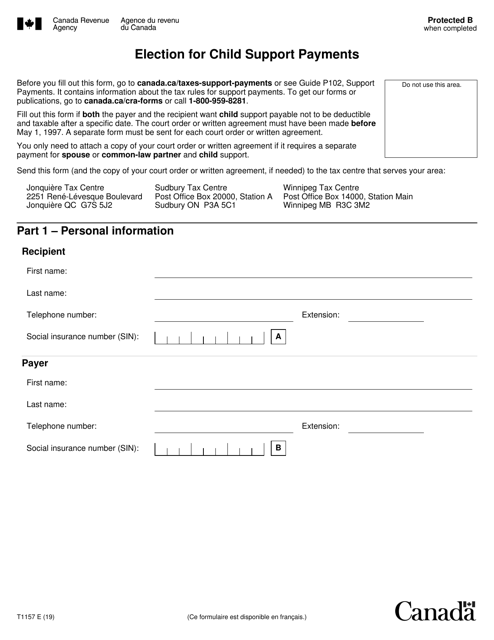

Form T1157 Download Printable Pdf Or Fill Online Election For Child Support Payments Canada Templateroller

Form T1157 Download Printable Pdf Or Fill Online Election For Child Support Payments Canada Templateroller

Statement Of Business Or Professional Activities Page 1 Business Names Statement You Changed

Statement Of Business Or Professional Activities Page 1 Business Names Statement You Changed

Statement Of Business Activities Fill Online Printable Fillable Blank Pdffiller

Statement Of Business Activities Fill Online Printable Fillable Blank Pdffiller

Pd4r Fill Online Printable Fillable Blank Pdffiller

Pd4r Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Government Of Canada Pdf Forms

Fill Free Fillable Government Of Canada Pdf Forms

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

Statement Of Business Or Professional Activities T2125 And Tp 80 H R Block Canada

Statement Of Business Or Professional Activities T2125 And Tp 80 H R Block Canada

2019 2021 Form Canada T2125 Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Canada T2125 Fill Online Printable Fillable Blank Pdffiller

Question About Self Employed Income And Expenses T2125 Personalfinancecanada

Fillable Online Cra Form T2125 Statement Of Business Or Professional Activities Fax Email Print Pdffiller

Fillable Online Cra Form T2125 Statement Of Business Or Professional Activities Fax Email Print Pdffiller