Should An Llc Receive A 1099 Nec

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. And the 1099-NEC is actually not a new form.

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Besides the filing of the 1099-NEC form you will also need to have the payee fill out and sign a Form W-9.

Should an llc receive a 1099 nec. However see Reportable payments to corporations later. The 1099-NEC only needs to be filed if the business has paid you 600 or more for the year. This is to get the correct Tax Payer Identification Number TIN like a Social Security.

Rest assured that theyll be able to help you. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. If business taxes where do I add it.

Form 1099-MISC although they may be taxable to the recipient. Its a common belief that businesses dont need to send out 1099-NEC forms to corporations. In addition to individuals a business may file a 1099-NEC to a partnership estate or corporation.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. They dont have to report payments that were made for personal reasons. Do you need to issue a 1099-NEC.

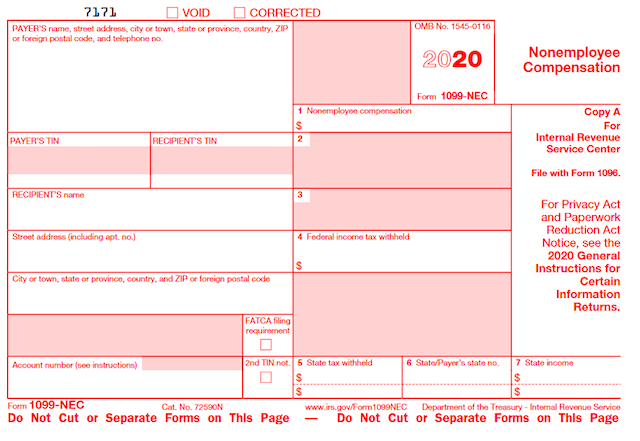

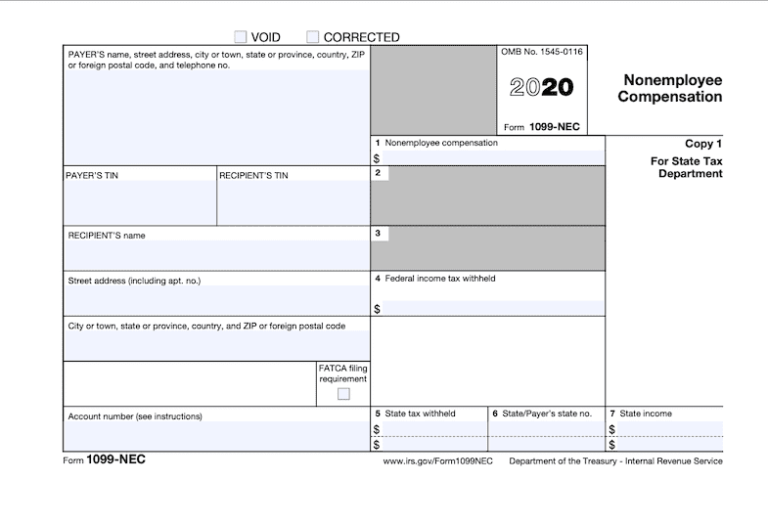

This is only required if you performed over 600 worth of. 3 How to Fill Out and Read Form 1099-NEC. Do I file that on my personal taxes or business taxes.

Businesses will use this form for payments for services as part of their trade or business. Payments for which a Form 1099-MISC is not required include all of the following. Businesses will need to use this.

Business owners only have to report payments for services or rent that were earned for business purposes. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. For LLCs taxed as either sole proprietors or partnerships youll need to receive a 1099-MISC from your clients.

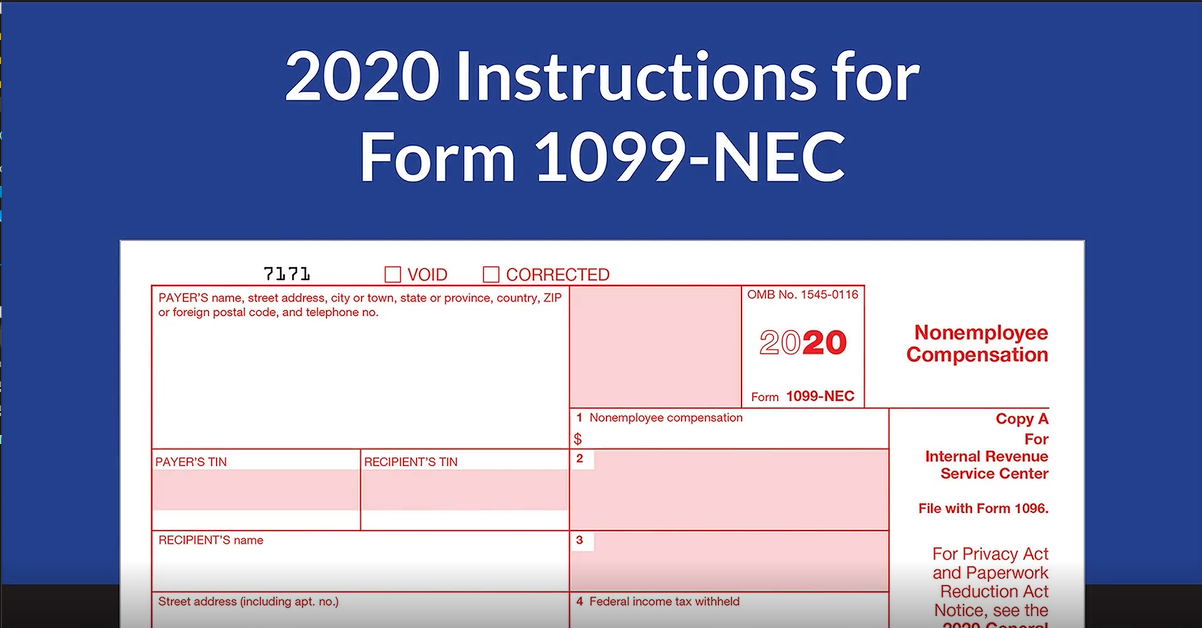

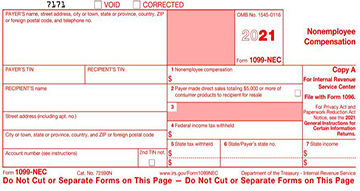

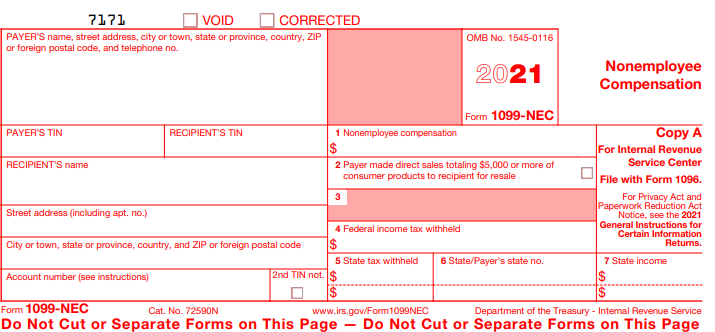

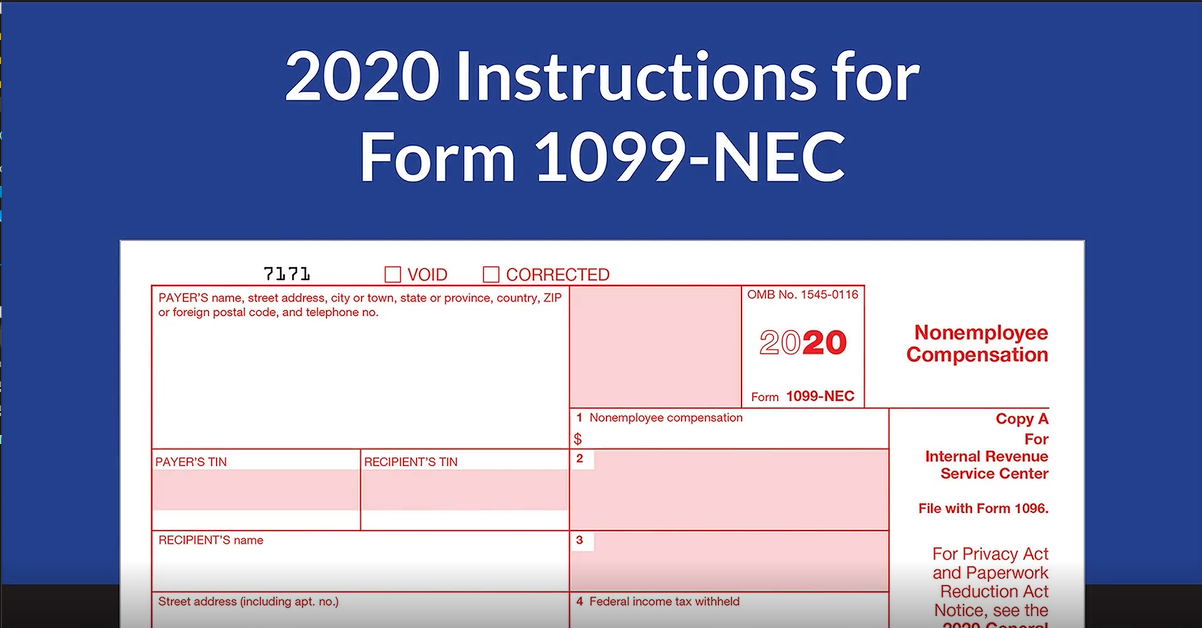

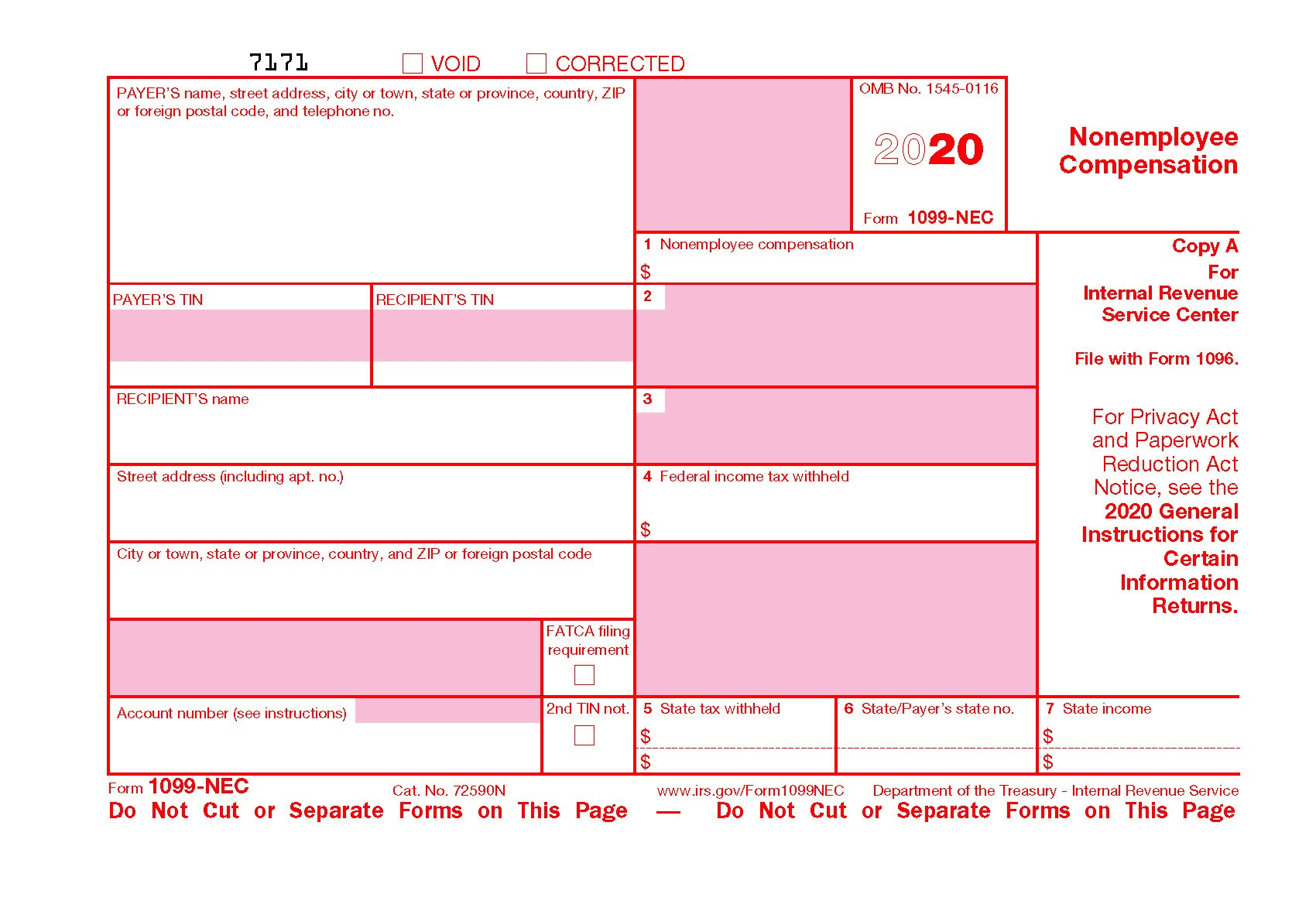

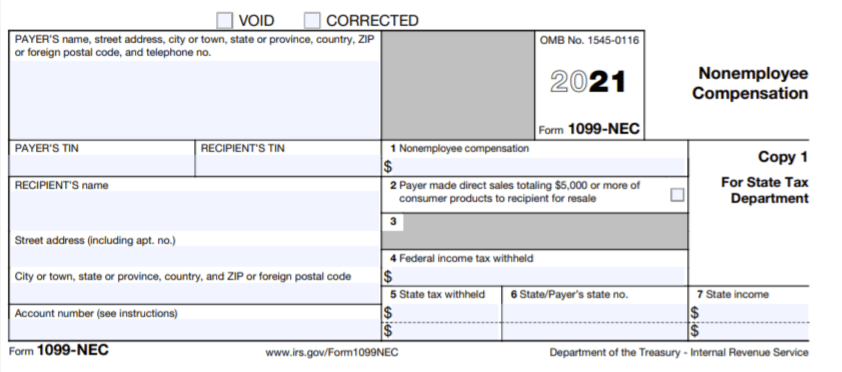

In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations. Of course when the end of the 2020 tax year comes you will also need to remember to actually fill out the Form 1099-NEC instead of the Form 1099-MISC for all of the nonemployee compensation payments. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments.

Businesses are required to send to people they paid more than 600 for services during the last calendar year. If youre a nonemployee and havent received your form by then contact the company directly to request it. Is there anything else the Accountant should know before I connect you.

I have a s corporation and I received a form 1099 nec. If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return. The answer is no because the kitchen remodeling was for personal not business reasons.

If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. On the other hand for all contractors who are set up as LLCs but not filing as corporations taxed as a partnership or single-member LLC your business will need to file 1099 forms for them. According to the IRS.

Form 1099-NEC must be filed with the IRS and given to nonemployees by January 31 after the reporting year. Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was 600 or more. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

And this is true. If youve worked as an independent contractor during 2020 a Form 1099-NEC should have landed in your mailbox or inbox around the end of January. You will need it for your personal tax return so its important to get it promptly.

The 1099-NEC Nonemployee Income is an informational form that US. If the LLC files as a corporation then no 1099 is required or you dont need to send 1099 to the LLC. What is Form 1099-NEC.

Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation. If you see its taxed as an S Corp or C Corp it does not need to receive a 1099-MISC or 1099-NEC. It was last used in 1982.

Form 1099-NEC is not a replacement for Form 1099-MISC.

Tax Forms For Yardi Voyager Genisis Breeze Onesite Accounting And Many More

Tax Forms For Yardi Voyager Genisis Breeze Onesite Accounting And Many More

What Is Form 1099 Nec Nonemployee Compensation

What Is Form 1099 Nec Nonemployee Compensation

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

I Received A Form 1099 Nec What Should I Do Godaddy Blog

I Received A Form 1099 Nec What Should I Do Godaddy Blog

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

What S The Irs Form 1099 Nec Atlantic Payroll Partners

What S The Irs Form 1099 Nec Atlantic Payroll Partners

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Efile 1099 Nec Efiling 1099 Nec Forms Electronically File Form 1099 Nec

Efile 1099 Nec Efiling 1099 Nec Forms Electronically File Form 1099 Nec

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec For Nonemployee Compensation

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager