What Does A Payroll Register Include

Check when your payroll ends. Garnishments A garnishment is a court-ordered deduction post-tax deduction.

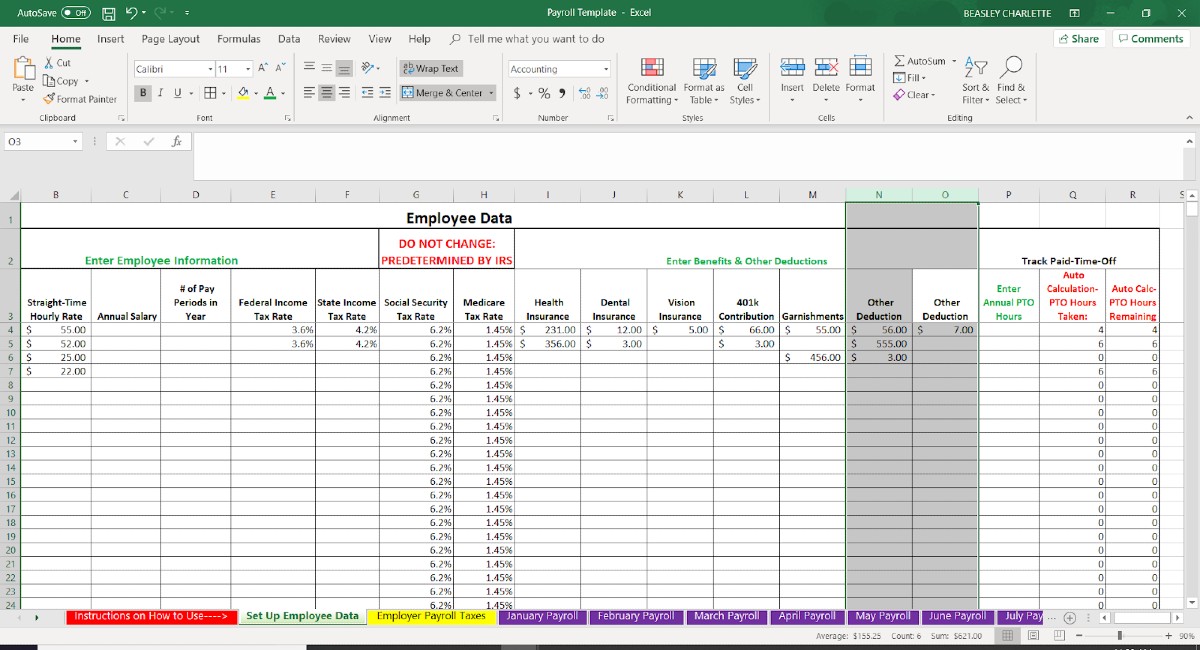

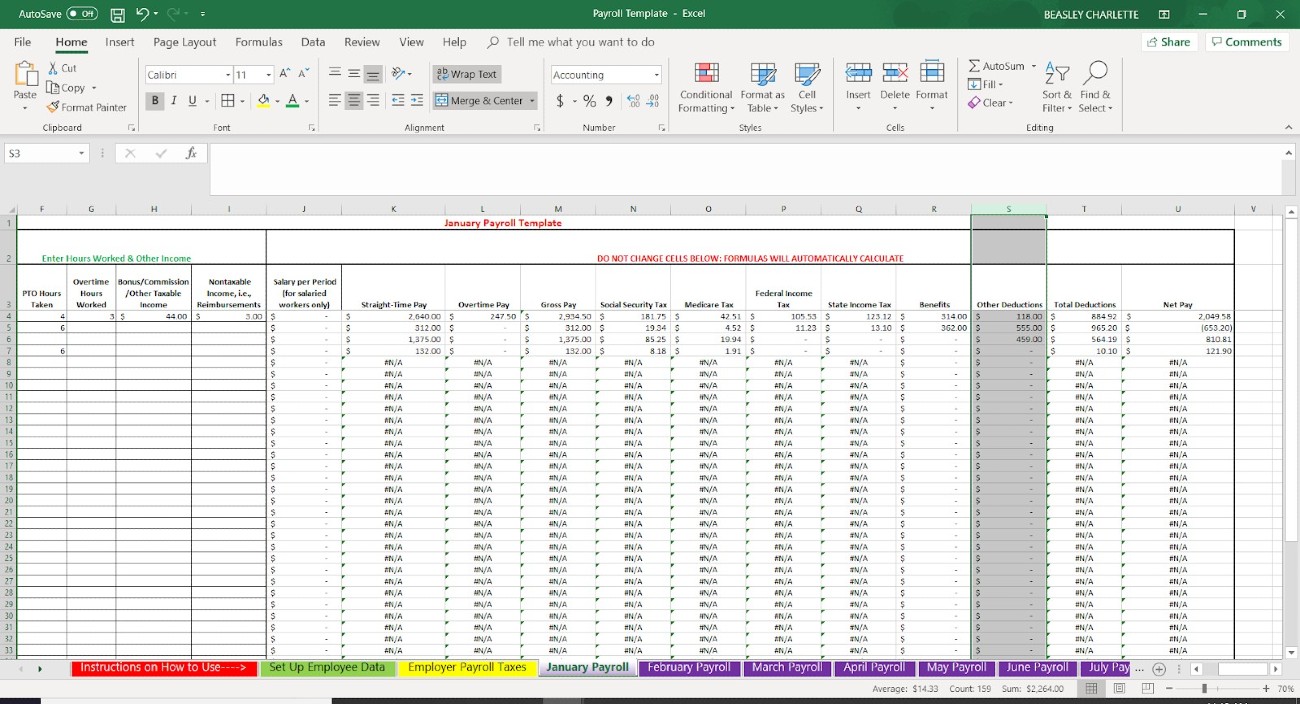

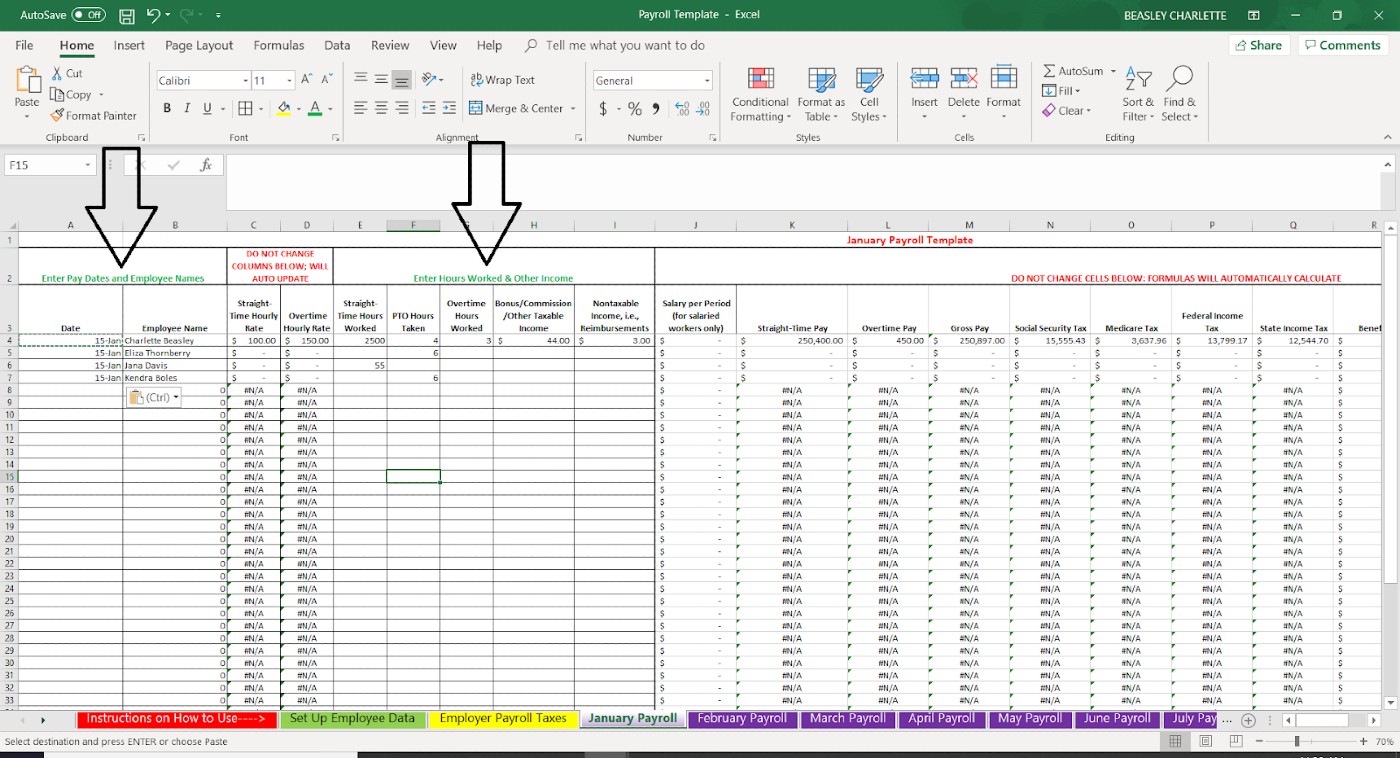

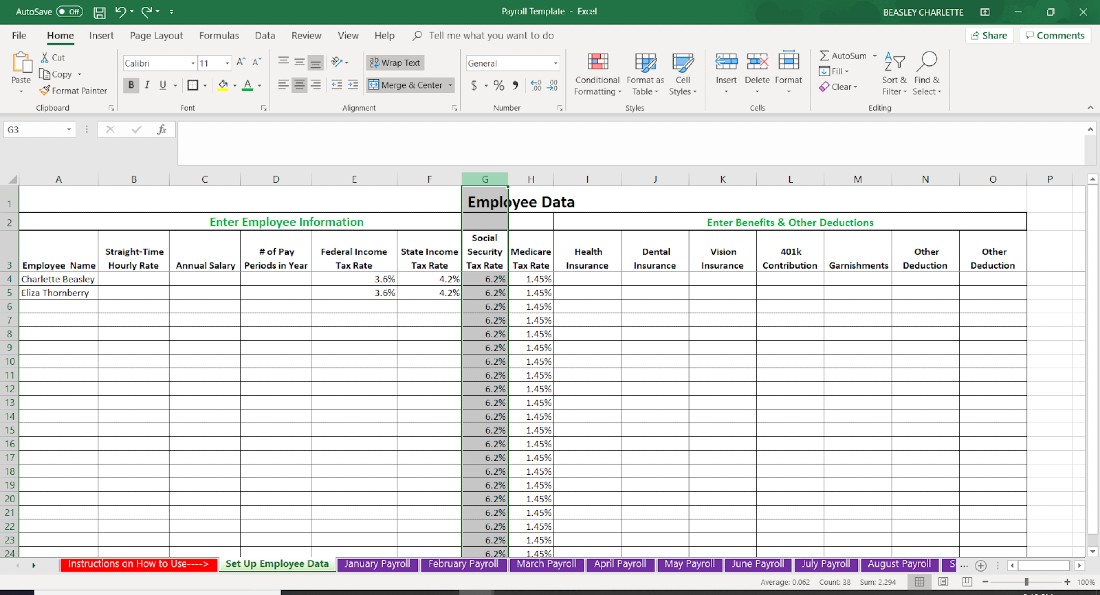

Payroll Calculator Professional Payroll Calculator For Excel

Payroll Calculator Professional Payroll Calculator For Excel

Most payroll summary reports include gross pay adjusted gross pay net pay and employer taxes and contributions for each employee.

What does a payroll register include. To understand these differences review each payroll component and determine if the component is a business expense. A payroll register is a spreadsheet that lists the total information from each payroll. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date.

PAYE is HM Revenue and Customs HMRC system to collect Income Tax and National Insurance from employment. Payroll also refers to the total amount of money employer pays to the employees. Dont forget to bring additional payroll documentation that.

You can think of it as a summary of all the payroll activity during a period. In other words a payroll register is the document that records all of the details about employees payroll during a period. Amounts you withhold from a workers pay and submit to a third party are not company expenses.

A payroll register is a business document that summarizes employees payroll activity for a specific period. In most countries the register will include the amount of federal taxes. Date range for payroll register.

Payroll expenses are what employers pay to hire workers. They might look similar to employee pay stubs. Using your payroll software you can generate your P60s and securely share them online with your employees.

State income payroll and unemployment tax filings Documentation including cancelled checks payment receipts transcripts of accounts or other documents verifying payments on covered mortgage obligations payments of covered lease obligations and covered utility payments Any other documentation the SBA Administrator determines is necessary. Employees federal tax allowances. A payroll register is a report that summarizes the payments made to employees as part of a payroll.

In other words a payroll register is the document that records all of the details about employees payroll during a period. You can think of it as a summary of all the payroll activity during a period. The payroll register should consist of a row for each employee with columns for each of the following pieces of information for the time period youre looking at.

Total gross pay the total of each type of deduction and total net pay are set out in a payroll register. It lists total information for employee payroll and includes gross pay deductions hours worked and net pay. Payroll is a list of employees who get paid by the company.

As an employer you normally have to operate PAYE as part of your payroll. The totals on this register can be used as the basis for a payroll journal entry. A payroll register does not include information about employer taxes.

The rows of a payroll register have information about individual employees. The calculations for each individual employee for total gross pay withholding and deduction amounts and total net pay are set out in an employee earnings record and the totals from all employee earnings for. The payroll register typically includes each of the payroll taxes Medicare Social Security and income tax and regular deductions such as health insurance and 401k contributions.

The information stated in a payroll register can include the following. Payroll taxes include federal income tax state income tax local income tax federal unemployment tax state unemployment tax Medicare tax and Social Security tax. As a business function it involves.

The payroll register typically includes each of the payroll taxes Medicare Social Security and income tax and regular deductions such as health insurance and 401k contributions. Developing organization pay policy including flexible benefits leave encashment policy etc. Print or export your report to Excel to share with your lender.

For each employee the payroll register includes. Use the list of eligible payroll costs to customize the payroll report to your needs. The payroll register records any tax deductions that are made from the gross pay.

What information does the payroll register show. Federal state and local income taxes Employee withholding for Social Security and Medicare taxes. Theres also the option to print them off if you need to.

Does your payroll end on week 52 or do you have a week 53 if the pay date falls on 5 April 20 21 to take into consideration. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date.

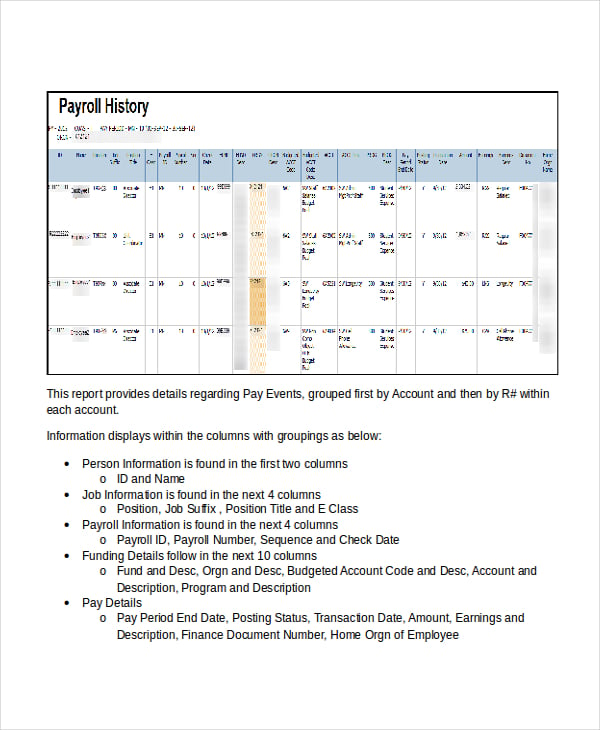

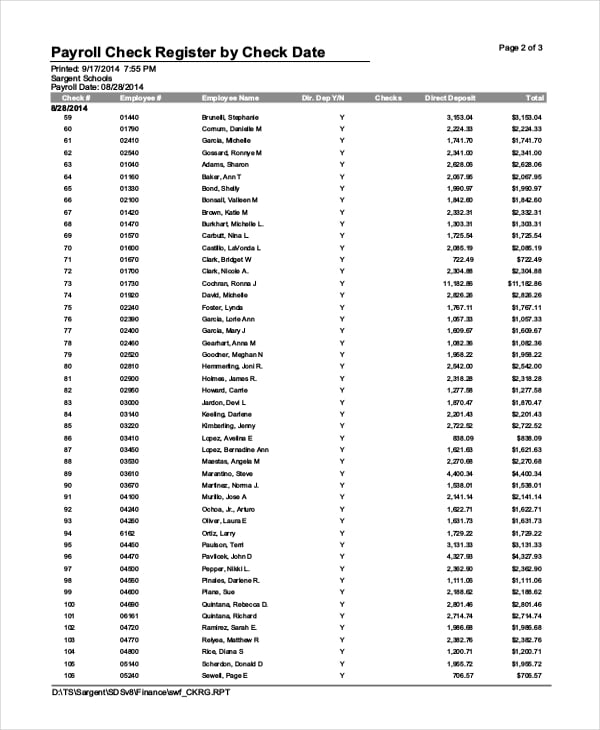

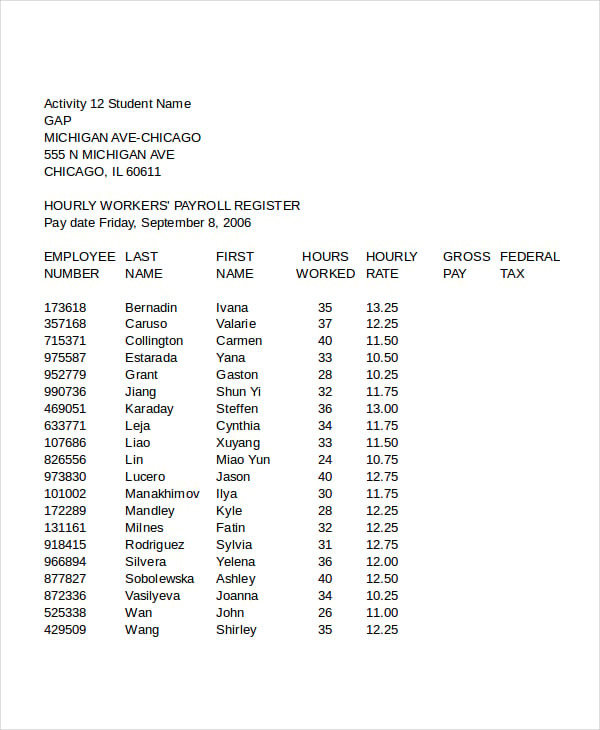

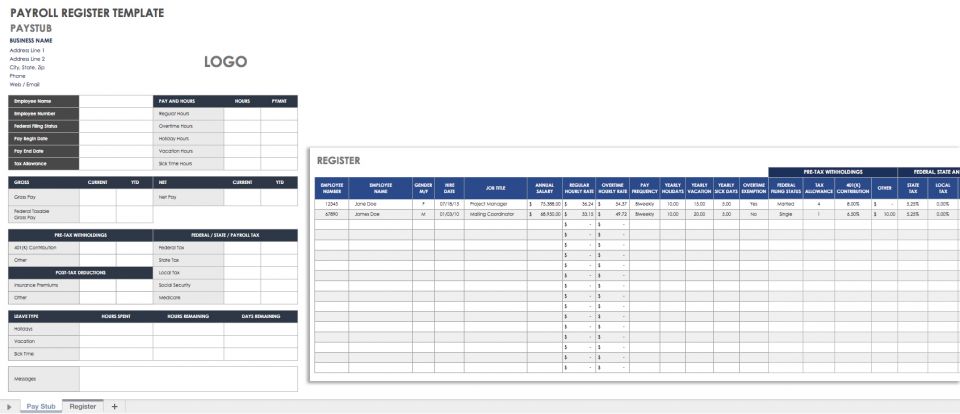

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

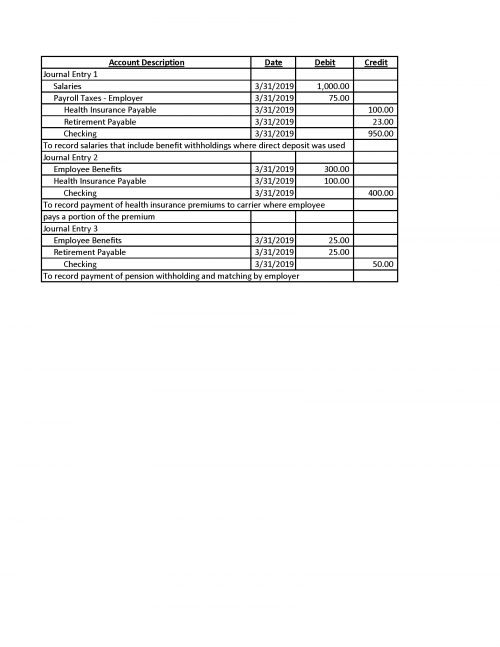

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

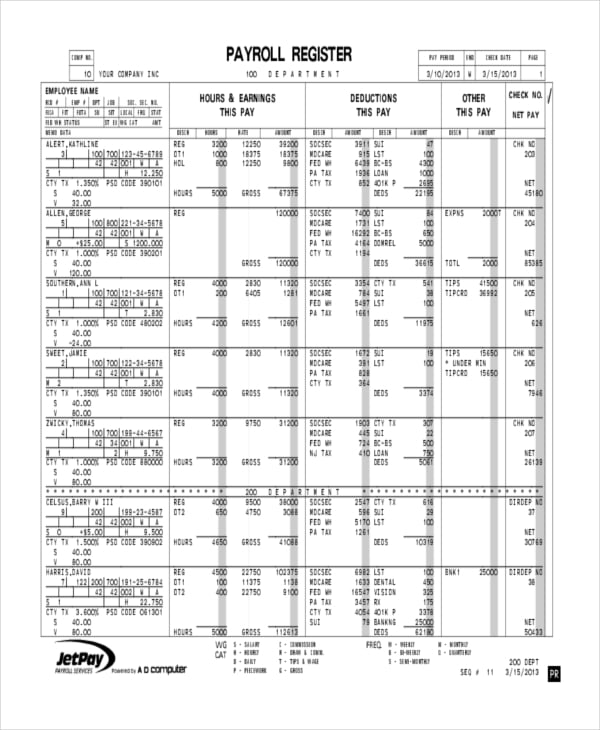

Payroll Register Template Cnbam

Payroll Register Template Cnbam

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template Cnbam

Payroll Register Template Cnbam

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Image Result For Employee Payroll Ledger Template Payroll Template Payroll Payroll Checks

Image Result For Employee Payroll Ledger Template Payroll Template Payroll Payroll Checks

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

15 Free Payroll Templates Smartsheet

15 Free Payroll Templates Smartsheet

Payroll Register Template Cnbam

Payroll Register Template Cnbam

Payroll Register Template Cnbam

Payroll Register Template Cnbam

Payroll Nonprofit Accounting Basics

Payroll Nonprofit Accounting Basics

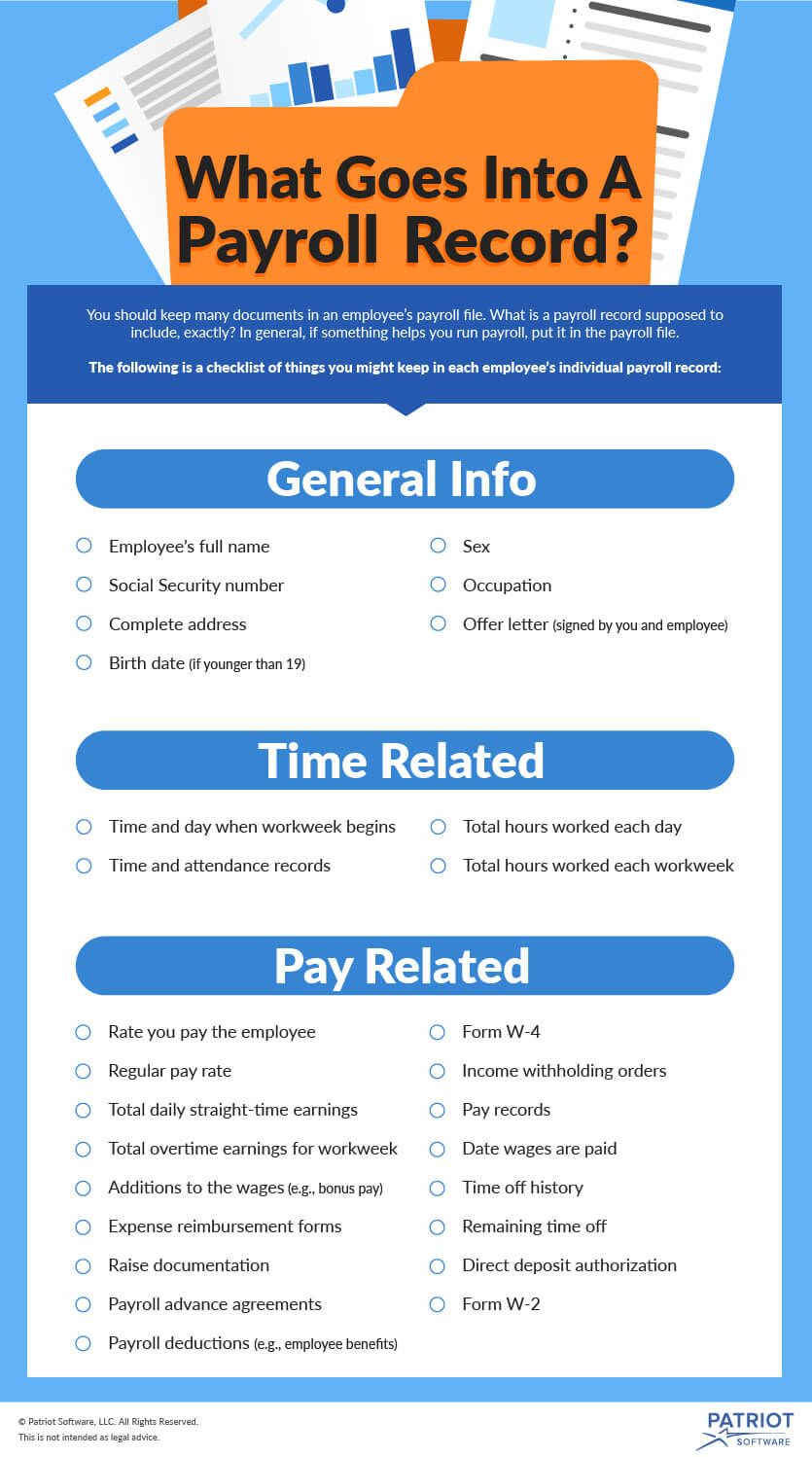

What Should I Include In My Employee Payroll Records

What Should I Include In My Employee Payroll Records

Payroll Register Template Cnbam

Payroll Register Template Cnbam