How To Get 1099 Form For Unemployment

The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. This is just a separator between the navigation and the help and search icons.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

How to get 1099 form for unemployment. For Pandemic Unemployment Assistance PUA claimants the. The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. 31 there is a chance your copy was lost in transit.

You can also download your 1099-G income statement from your unemployment benefits portal. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard. Your documents are scanned converted to an optical image and then processed by an automated workflow system.

Claimants may also request their 1099-G form via Tele-Serve. If you havent received your 1099-G copy in the mail by Jan. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

How Do I Get My Unemployment Tax Form. Unemployment Compensation Tax Reporting Related Forms The Contribution Section processes forms and correspondence via an electronic imaging system. You can receive a copy of your 1099-G Form multiple ways.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Call your local unemployment office to request a copy of your 1099-G by mail or fax. You can elect to be removed from the next years mailing by signing up for email notification.

To access this form please follow these instructions. These forms are available online from the NC DES or in the mail. 1099Gs are available to view and print online through our Individual Online Services.

These forms will be mailed to the address that DES has on file for you. Look for the 1099-G form youll be getting online or in the mail. Press 2 Individual.

It will be mailed by January 31 of the following year. Follow the prompts to schedule a callback. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

Remember even if you were unemployed you still have to file income taxes. 1099G is a tax form sent to people who have received unemployment insurance benefits. How to Get Your 1099-G online.

If you received unemployment insurance benefits during any calendar year ending 1231 from January 1 - December 31 you will receive a 1099-G for that year only. Go to Services for Individuals Unemployment Services and select Form 1099-G Information from the sub-navigation options presented. If you were a phone filer it will.

Unemployment is taxable income. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes. 18 hours agoThe Colorado Department of Labor and Employment says the most important and first step to take if you receive an inaccurate 1099-G or Reliacard and never filed for unemployment is.

On the row marked 2020 click View to open a. The 1099G forms for Regular Unemployment Compensation UC is now available to download online. You may choose one of the two methods below to get your 1099-G tax form.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. The 1099G form reports the gross. Press 2 Other questions about your 1099-G.

The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online. The 1099-G will be mailed to the address on file with the Maryland Department of Labor. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

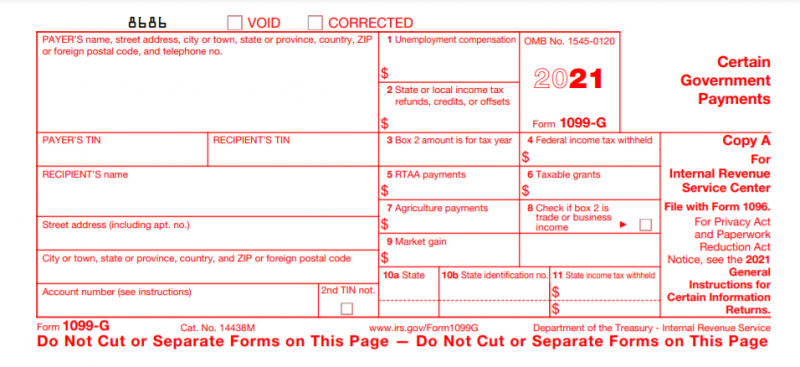

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org