Is It Better To Start A Corporation Or Llc

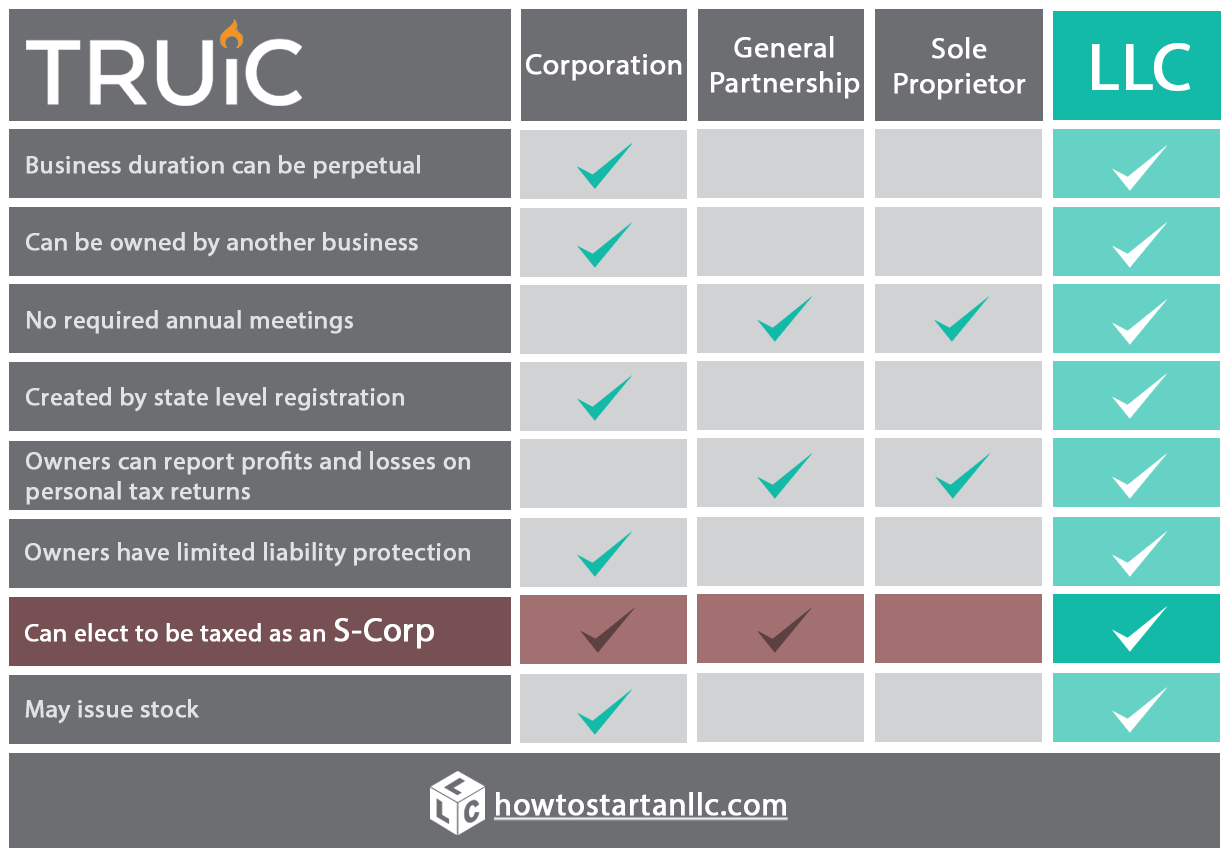

An S corporation on the other hand is a type of corporation. While both the LLC and S corporation structures will protect your personal assets many entrepreneurs prefer the fact that the LLC requires fewer formalities and filings over time.

Llc Vs Inc Which Is Better For Your Business Legalzoom Com

Llc Vs Inc Which Is Better For Your Business Legalzoom Com

Similar to C corporations LLCs.

Is it better to start a corporation or llc. The LLCs owners are called members and each Member owns a percentage of the LLC by virtue of owning a Membership Interest in the company. An established corporate structurewith all those legal requirements that can seem so onerousnow works to your benefit. The decision to incorporate or form a limited liability company LLC often depends on your business strategy and objectives anticipated size of the business opportunities for growth and expansion annual reporting requirements preferred taxation structure desire for limited personal liability and other significant factors.

The legal standards a corporation must meet also give a powerful legitimacy to the business that make it easier to attract new capital. An LLC or limited liability company offers the same personal liability shield to each of its owners that a corporation offers. LLCs are common since they provide the liability thats similar to a corporation but they are easier to establish.

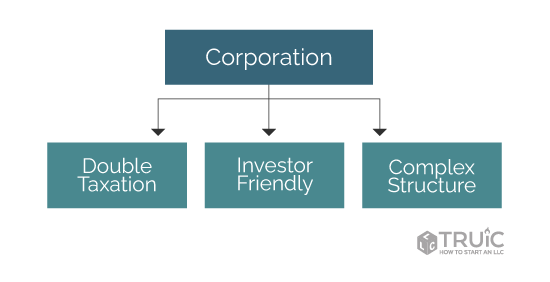

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. Corporations are a good choice for a business that plans to seek outside investment. That way its liable for its own debts and obligations.

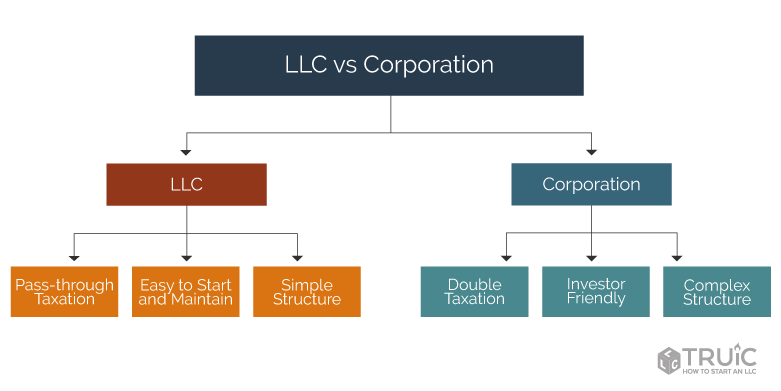

LLCs provide great flexibility. Corporate management structures are far more rigid than those of an LLC. Advantages of an LLC The main advantage of an LLC vs a sole proprietor is the legal and financial protection it provides for its members.

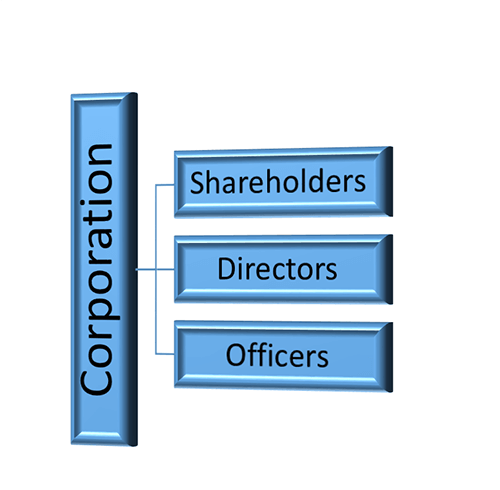

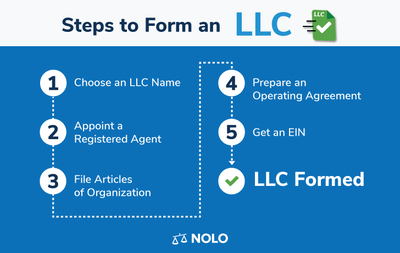

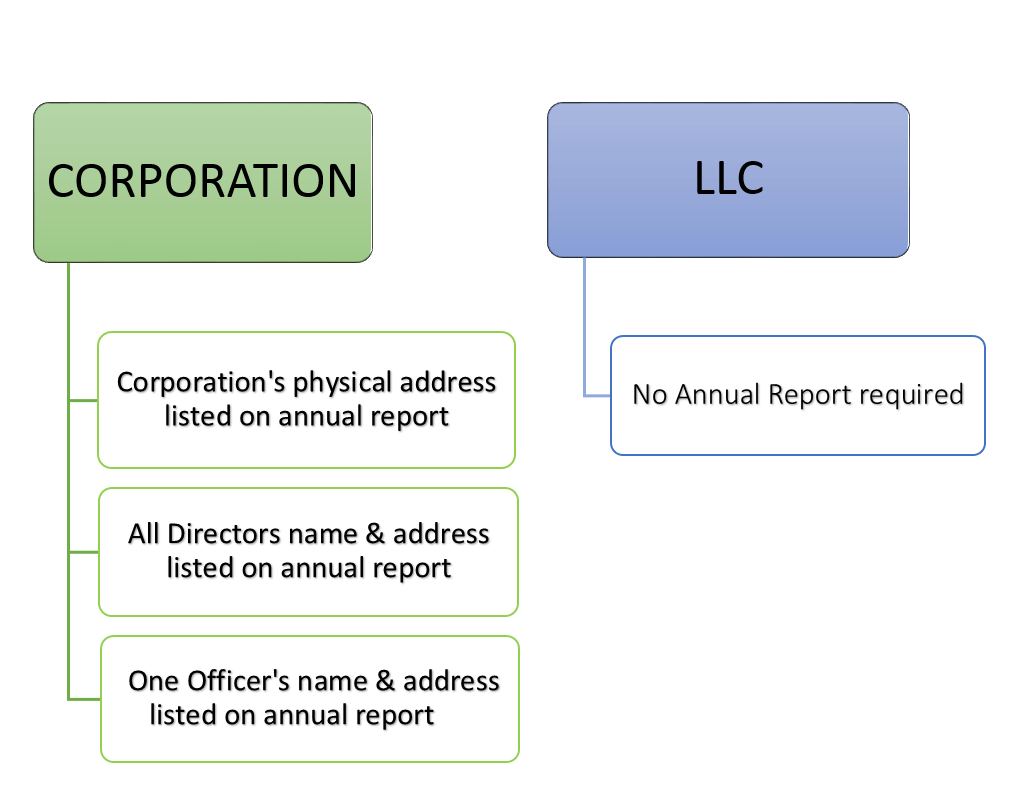

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals and a corporation is owned by its shareholders. Generally most entrepreneurs choose to form a Corporation or a Limited Liability Company LLC. Ease of Forming an LLC Creating an LLC is a much simpler process than creating a corporation and generally takes less paperwork.

Akalp explains the benefits of the LLC saying Forming an LLC is like having your cake and eating it too. Honestly it depends. No matter which entity you choose both entities offer big benefits to your business.

It normally doesnt take that much initial capital to get an independent contracting business up and running but turning your business into an LLC does limit your liability for any ensuing suits or disputes. Limited liability means you cant be. In fact with an LLC Operating Agreement you can essentially create the management structure of your choosing.

The LLC is essentially an organized partnership offering the same protections as corporations but with much more flexibility. A major advantage of organizing your business as an LLC or an S corp is that you can protect your personal assets from the creditors of your business. Effectively forming an LLC turns your business into its own separate entity.

Its easier to calculate and distribute equity with a corporation than an LLC. Filing to become an LLC is a good approach to begin with because this structure offers liability protection and tax write-offs. An LLC also provides greater flexibility in ownership and.

LLCs have far less paperwork up front and in the long-term. However as your business grows beyond the. The last reason to form a corporation over an LLC is if youre interested in offering your employees equity in.

LLCs are favored by small owner-managed businesses that want flexibility without a lot of corporate formality.

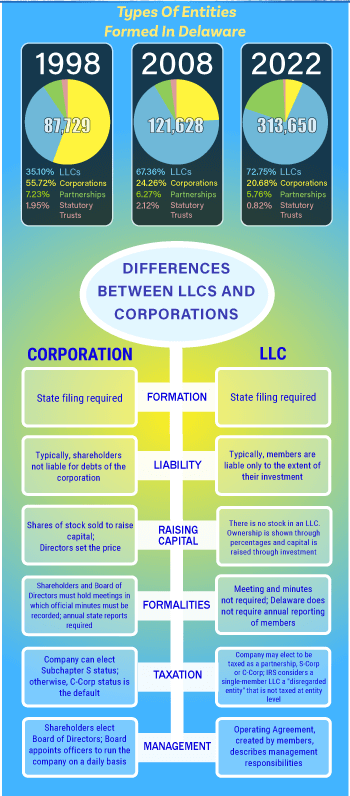

Llc Vs Corporation The Differences Harvard Business Services

Llc Vs Corporation The Differences Harvard Business Services

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

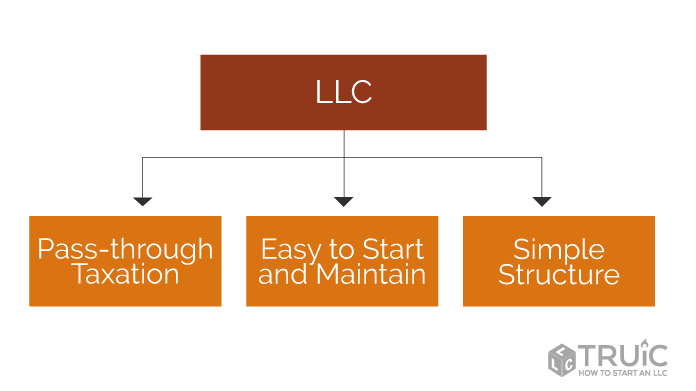

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

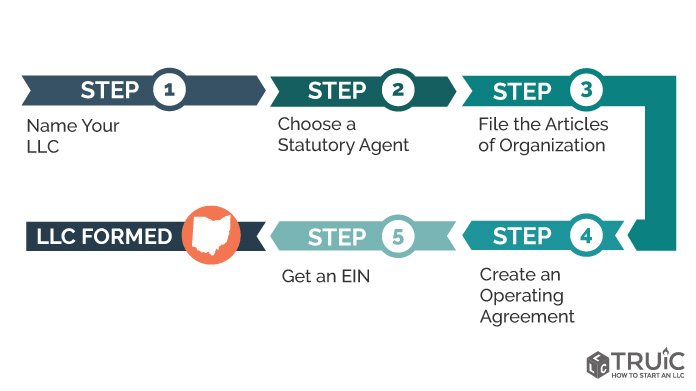

Llc Ohio How To Start An Llc In Ohio Truic Guides

Llc Ohio How To Start An Llc In Ohio Truic Guides

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

What Is An Llc Llc Pros And Cons Nolo

What Is An Llc Llc Pros And Cons Nolo

Llc Vs Corporation The Differences Harvard Business Services

Llc Vs Corporation The Differences Harvard Business Services

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Llc Meaning Limited Liability Company Definition

Llc Meaning Limited Liability Company Definition

How To Form A Llc Step By Step Guide Community Tax

How To Form A Llc Step By Step Guide Community Tax

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Llc Vs Corporation The Differences Harvard Business Services

Llc Vs Corporation The Differences Harvard Business Services

State Of Florida Com Incorporate In Florida

State Of Florida Com Incorporate In Florida

How To Form A Llc Step By Step Guide Community Tax

How To Form A Llc Step By Step Guide Community Tax

How To Form A Llc Step By Step Guide Community Tax

How To Form A Llc Step By Step Guide Community Tax

Llp Vs Llc What S Best For Your Business

Llc Meaning Limited Liability Company Definition

Llc Meaning Limited Liability Company Definition