How To Get A Copy Of 1099 From Quickbooks

To print out a 1099 report to provide to your accountant or to import into another 3rd party payroll or 1099 filing system do the following. Click the Help icon in the upper right-hand corner of the Dashboard.

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Data Services

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Data Services

I just want to get a darn copy of the 1099s that QBO filed on my behalf.

How to get a copy of 1099 from quickbooks. Click I still need a human. To generate a copy of W-3. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

When I follow these instructions to do step 5 as print mail it wants me to pay 58 to buy red 1099 forms. Select Talk to a Human. Scroll down to the Expenses and Vendors section under standard reports.

Federal Copy for the IRS. A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year. Outsource it all to a tax pro.

It should show all Forms 1099 issued under your Social Security number. Without them I assume its just going to print the. So to print 1099 in QuickBooks Online scroll down a bit more and click the Print and Mail button.

Click on Reports on the left-side navigation bar. The payer should send you a copy of your 1099 by January 31st. Select Expenses from the left menu then Vendors.

We werent required to order a QuickBooks 1099 kit. Read more on our blog. Either follow the on-screen instructions or press Back until youre on Step 4 depending on where you left off.

Select the tax year from the drop-down list and since we are filing form 1099 select 1099 from the two provided options. If you worked as an independent contractor or received any other payment that needs to be reported on a 1099 then you should reach out to the person or business that paid you. Beware taxpayers have been able to pass the strict authentication process only 30 of the time.

From QuickBooks Online navigate to the Expenses tab and the Vendors section. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. Set up an IRS account and download your transcripts online.

How to find and produce 1099 reports in Quickbooks Heres how to get the report that lists all of your 1099 vendors. Select the 1099 Transaction Detail Report then export to pdf or excel. How to prepare and file 1099s with QuickBooks Desktop Go to Vendors and select PrintE-file 1099s.

Click Taxes then select Payroll Tax. Transcripts will arrive in about 10 days. The test sheet can then be held up to the light with the forms to see if the boxes match.

When we ran through this process ourselves selecting Print Mail Ill File Myself took us straight to the next page where we could print our 1099s ie. Choose Get a callback. Purchasing more isnt necessary.

State and Local Copies. Use IRS Get Transcript. To print finished copies of 1099-MISC forms please follow the steps below.

The number of 1099 pars needed is based on government filing requirements. Click the filter menu funnel icon in the top-left of your Contractor list and choose. Enter a short description of your concern and press Enter.

Choose 1099 Wizard then select Get Started. But you have your own forms and youre ready to print. AK CA FL GA IL IN IA KY LA MD MI MO NV NH NM NY OR SD TN TX VT WA WY.

Click the printer icon to print. Decoding 1099-MISC Copy Requirements. Select Contact Us to connect with our live support.

Choose Lets get started Continue your 1099s and you are prompted to review your form. In the Forms section select Annual Forms. Choose a filing method click Print 1099s ensure the dates are correct and click Ok - Ensure all the vendors are selected for printing the 1099-MISC and 1096 forms click Print 1099 and start by printing one blank test sheet for the 1099 and 1096 forms.

QuickBooks Online suggests that you need to purchase a QuickBooks 1099 kit to proceed. How to print off a copy of a prior years 1099 and 1096 Visit our website. I have this same problem.

From the left menu select Reports. Keep in mind that if your total payments for the prior year are under 600 the IRS threshold they may not need to send you a 1099. Call 800 908-9946 or go to Get Transcript by Mail.

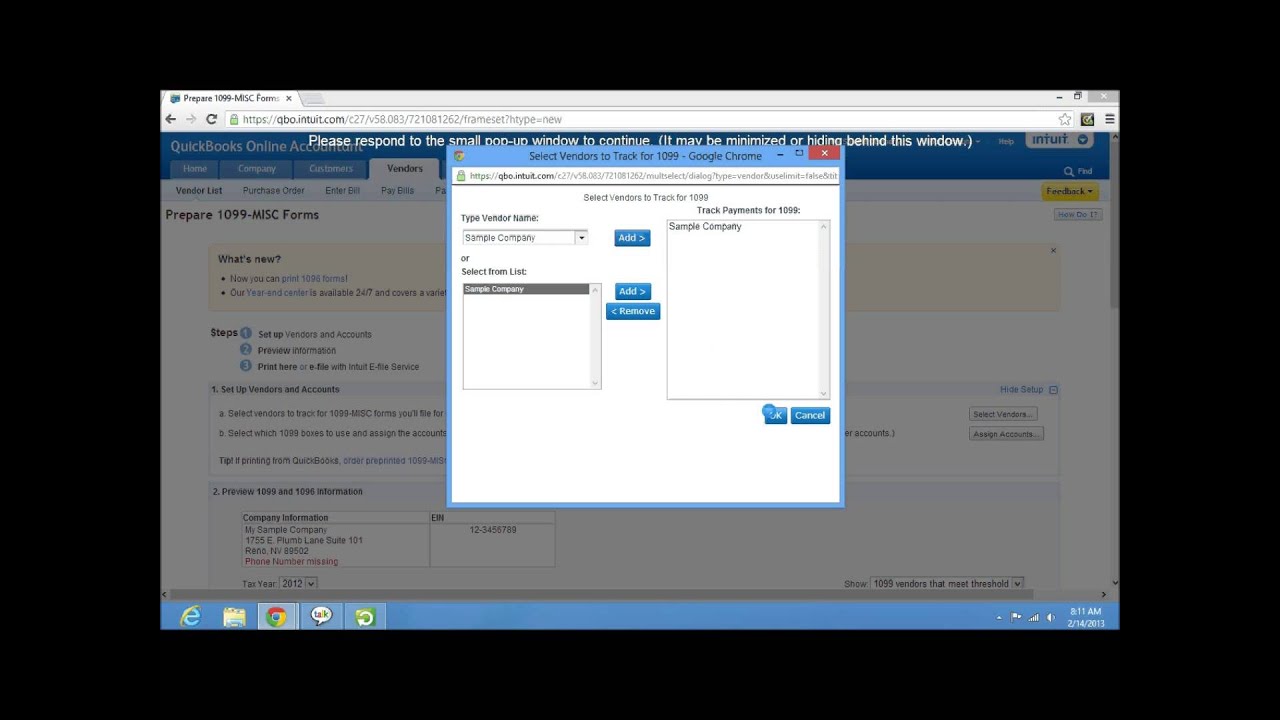

Launch the QuickBooks 1099 wizard from the File menu by clicking Print Forms and 1099s1096 Step 2 Check the Create Form 1099-MISC box for each 1099 vendor. Once everything looks good click Yes Looks Good to proceed further.

How To Set Up 1099 Tracking In Quickbooks Quickbooks Online Or Xero Accountex Report Quickbooks Online Quickbooks Sole Proprietor

How To Set Up 1099 Tracking In Quickbooks Quickbooks Online Or Xero Accountex Report Quickbooks Online Quickbooks Sole Proprietor

Doug Sleeter On About Me Quickbooks Create Invoice Quickbooks Tutorial

Doug Sleeter On About Me Quickbooks Create Invoice Quickbooks Tutorial

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

Quickbooks 1099 Overview And Tips 2014 2015 Quickbooks Online Quickbooks Quickbooks Online Quickbooks Online Plus

Quickbooks 1099 Overview And Tips 2014 2015 Quickbooks Online Quickbooks Quickbooks Online Quickbooks Online Plus

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Need A New License Key To Activate My Quickbooks Please I Am Using Quickbooks Version 2010 2011 Version Quickbooks Norton Internet Security Internet Security

Need A New License Key To Activate My Quickbooks Please I Am Using Quickbooks Version 2010 2011 Version Quickbooks Norton Internet Security Internet Security

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Set Up Printing Alignment For 1099 Tax Forms In Quickbooks 1099 Tax Form Tax Forms Quickbooks

Set Up Printing Alignment For 1099 Tax Forms In Quickbooks 1099 Tax Form Tax Forms Quickbooks

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Download W2 Form 2015 W2 For Quickbooks 1099 For Quickbooks Printable Job Applications Templates Resume Design Free

Download W2 Form 2015 W2 For Quickbooks 1099 For Quickbooks Printable Job Applications Templates Resume Design Free

Try These Steps With Quickbooks 1099 Wizard To File 1099 Taxes Quickbooks Quickbooks Online Irs Website

Try These Steps With Quickbooks 1099 Wizard To File 1099 Taxes Quickbooks Quickbooks Online Irs Website

Complete Guide For Quickbooks Online 1099 Setup Quickbooks Online Quickbooks Data Services

Complete Guide For Quickbooks Online 1099 Setup Quickbooks Online Quickbooks Data Services

How To Create A 1099 Report In Quickbooks Online Quickbooks Quickbooks Online Online

How To Create A 1099 Report In Quickbooks Online Quickbooks Quickbooks Online Online

Quickbooks Retained Earnings Quickbooks Quickbooks Online Balance Sheet

Quickbooks Retained Earnings Quickbooks Quickbooks Online Balance Sheet

Migrate Quickbooks Payroll From Older Computer To New One In 2020 Quickbooks Payroll Quickbooks Payroll

Migrate Quickbooks Payroll From Older Computer To New One In 2020 Quickbooks Payroll Quickbooks Payroll